Bank account numbers are essential pieces of information that identify your account and allow you to carry out transactions. They are unique identifiers that help banks differentiate your account from others, and they typically include a routing number, account number, and check number. Your account number is a critical piece of information that you must protect, as it can lead to various problems if it falls into the wrong hands. Fraudsters can use your account number to make unauthorized purchases or access your funds. Therefore, it’s crucial to keep your account number secure and only share it with trusted individuals.

Why Is Ordering Pre-Printed Checks Not a Secure Option?

Pre-printed checks are not a secure option as they display sensitive bank information, such as routing number, account number, and check number, making them susceptible to fraudulent activities. Additionally, for businesses, the cost of ordering and securely storing a large quantity of pre-printed checks can be challenging. On the other hand, printing checks on blank stock paper is a more efficient and cost-effective alternative, which can help to prevent sensitive information from falling into the wrong hands.

How Can Zil Money Offer a Safer and More Efficient Option for Printing Your Account Number on a Check?

Print the account number on your check using our platform, Zil Money, which is ideal for you and your business. The account number is an important piece of information if it falls into the wrong hand, it will be problematic. You can print them instantly as needed, eliminating the need for secure storage and reducing the risk of fraud or information theft.

Bank Account Number

A bank account number is a unique identifier for your account at a banking institution. It acts as a form of identification for your funds and allows for the secure transfer of money and payment for services without any risk of confusion.

Consisting of 24 characters, your bank account number includes a 20-character customer account code (CAC) that is specific to each individual customer at any given bank. The remaining four characters consist of two control numbers and two country code characters.

The two country code characters are letters that represent the country where the bank account is located. The control numbers correspond to these letters and are used for validation purposes.

The remaining 20 characters of the bank account number consist of the bank code, sort code, control numbers, and account number. The bank code identifies the specific bank where the account is held, while the sort code identifies the branch where the account was opened. The control numbers in this section are used to validate the account. Finally, the account number itself is a ten-character string that is unique to each individual account and can never be duplicated.

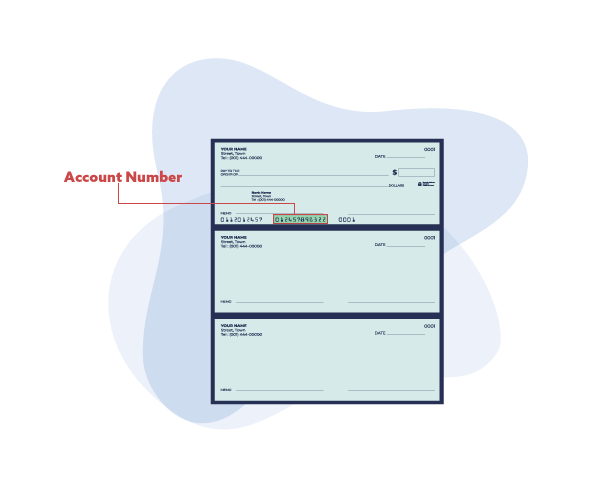

Where to Find Your Bank Account Number on a Check?

To find your bank account number, take a look at the bottom of your paper check. Between the nine-digit routing numbers, you’ll find a second set of numbers. Your account number is the longer of the two, and it’s a unique identifier for your bank account. You can access your account number through your paper checks or by logging into your online account. This number can also be found on your account statement.

Zil Money: Print Routing, Check, and Account Number on Your Checks

Zil Money allows you to print your checks easily on-demand with routing, check, and account number on blank or regular paper. You can customize your checks using our design tool and send digital checks via email or the ACH network. Save time and money with Zil Money.

A Bank account number is a critical piece of information that identifies your account and allows for successful transactions. Therefore, it’s crucial to keep your account number secure and only share it with trusted individuals. By taking necessary precautions to protect your account number and utilizing online check-writing services like Zil Money, you can ensure the safety and efficiency of your banking transactions.