Happy Customers

New Customers a Week

Transactions Per Week

Easy and Secure Payments

Zil Money’s Virtual Card API is a convenient solution that improves online transactions for businesses. Since virtual cards only exist digitally, your customers don’t have to worry about stolen or misplaced cards. Moreover, virtual cards can be stored on smartphones or other devices, making them more accessible. And for better security, a mobile app allows customers to lock their cards with a single tap.

Features at Your Fingertips

From accounts payable and receivable functionalities to comprehensive online payment and beneficial integrations, Zil Money can meet the payment management requirements of all types of businesses.

Check Printing

Drag and drop to instantly create checks & print using any printer.

Pay By Credit Card

Use credit cards even when your vendors don't accept them.

ACH Payment

Make one-time or recurring ACH/RTP payments in one click.

Wire Transfers

Send money electronically from one financial institution to another.

Bill Pay

Pay & schedule bills online, managing supplier payments & reducing risk.

Digital Checks

Digitize your paper checks and make your payments via email or text.

Software Integrations

Integrate Zil Money with your accounting and payroll software.

Cloud Bank

Open an online checking account with Zil.us. Streamline payment management & save.

Payment Link

Create and send a secure URL for customers to make online payments easily.

Why Choose Zil Money?

Zil Money is an all-in-one payment platform that is integrated with over 22,000 banks and financial institutions in the US and Canada. As such, businesses can print any bank checks and reconcile the bank accounts instantly without any delays. You can also track cash flow and generate reports for enhanced financial management. Zil Money is a trusted solution for simplifying your payment processes.

Why Zil Money!

A technology-first approach to payments and finance

Easy to Access

High Security

Easy Payment

Diverse Payment Alternatives

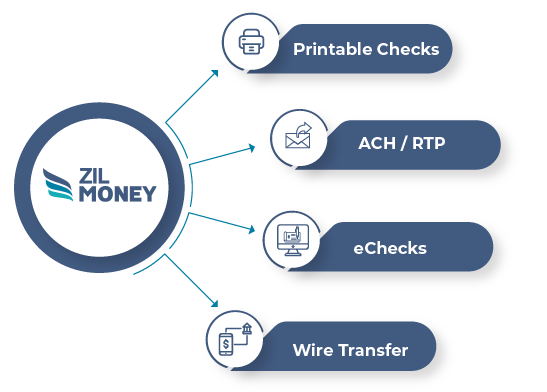

Zil Money offers flexibility through different payment options like ACH, wire transfer, printable checks, and eChecks. Users can choose the best method based on their needs and reduce costs. The Pay by Credit Card feature will allow businesses to earn rewards while improving cash flow. The platform provides the complete package of payment solutions for small and medium sized businesses.

$50B+

In total transaction volume

22K+

Connected banks & financial institutions

20K+

Monthly business users

1M+

Total users, and growing

Mobile Payments Made Easy

Zil Money’s digital wallet makes it easier to transfer funds using methods like ACH, virtual cards, checks, and wire transfers while on the move. When the wallet balance is low, users can easily add more funds, ensuring their financial needs are met without any problems. The platform also offers instant transaction records, which is a great source of financial data for better insights.

FREQUENTLY ASKED QUESTIONS

How to use virtual card?

How to create virtual card?

Can you use virtual card in store?

Virtual Card vs Physical Cards

Trusted By The Leading Brands Around The World