Pay Your Payroll with Credit Card

Seamlessly run any payroll with our cutting-edge credit card solution

Happy Customers

New Customers a Week

Transactions Per Week

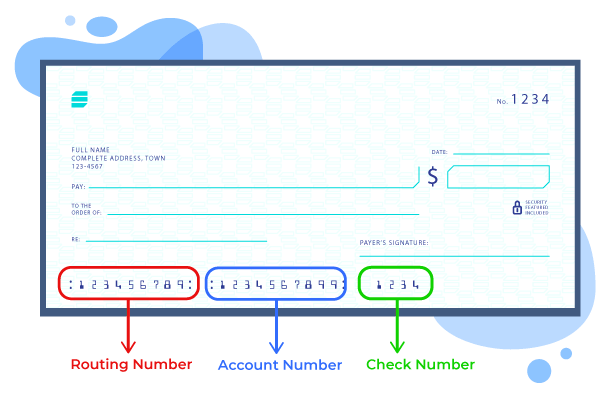

Bank Account Number and Routing Number

There are three sets of bank account code at the bottom of a check. On the left is the bank account routing number on a check, the second is the bank account number, and the third is the check number. In addition, Zil Money helps you print checks instantly with the check routing number and account number on it. There is no need for a MICR code after the Check 21 Act. You can print checks on blank stock paper using a regular printer from anywhere.

Print Bank Account Numbers on Blank Checks

With Zil Money, you can print checks on premium paper at home or the office. Using the cloud-based printing software, you can print checks on blank check stock with your bank account code and necessary details using any printer.

Why Zil Money!

A technology-first approach to payments and finance

Easy to Access

High Security

Easy Payment

Online Payments

Zil Money streamlines online payments, ensuring security and ease of use for various payment methods such as ACH, eCheck, RTP, and more. This simplification of online banking benefits businesses and individuals by saving time and enhancing efficiency. Additionally, Zil Money offers a straightforward solution for managing bill payments and client transactions through mobile banking.

$50B+

In total transaction volume

22K+

Connected banks & financial institutions

20K+

Monthly business users

1M+

Total users, and growing

Secured Transactions

Enjoy the convenience of swift and secure transactions from the comfort of your home using the free online banking platform. The entire transaction process is automated, ensuring peace of mind regarding payment security. The platform boasts state-of-the-art security features, safeguarding all your confidential financial data. With this top-notch online banking software, you can efficiently handle everyday transactions and manage all your financial affairs in one secure location. Furthermore, this software integrates with over 22,000 banks and financial institutions in the United States and Canada.

FREQUENTLY ASKED QUESTIONS

Where is the account number on the check?

How many digits is an account number?

How much does a box of checks cost?

What is the easiest bank account to open online?

Check Account Number and Routing Number

PRECIOUS REVIEWS FROM

OUR CUSTOMERS

Vendor Management: Easily handle bill payments, instant check printing and mailing, invoicing, positive pay, and access User/API features across various platforms.

User-Friendly Interface: Zil Money's interface is intuitive and easy to navigate, making it accessible for users of varying technical proficiency.

Ana

Ease of deployment and use. Normally, a switch like this is both time-consuming and confusing, but in this case, it was super easy.

Jennifer

The dashboard and the customer support are amazing! Never has a company been there like Zil Money and answered all my questions before letting me go. Thank you.

Stephanie

I love that I am able to process payments and do ACH transfers very easily.

Ardinay

Total Money Moved

9,520,030,217 +

Total People Paid

1,020,421 +

Total Businesses Satisfied