The checkbook continues to be an important aspect of financial management. Checks are still a popular choice for many because they ensure quick access to funds and security for the recipient as the agreed-upon amount is deposited into the bank.

Although online options are more convenient, checkbooks offer a physical, safe method for conducting transactions, especially in cases where online payments are not possible. For travel agencies that work with many different suppliers and clients, checkbooks are a dependable way to make payments and process refunds.

Click Here To See Interactive Demo⬇

What Is a Checkbook?

A checkbook is a booklet containing checks that are issued by financial institutions to checking account holders. You can use these checks to buy things or pay bills.

Pros of a Checkbook

- There are various risks associated with carrying physical cash as it can be easily stolen or misplaced. When you write a check, only the person you give it can cash it.

- Every check handed over acts as a record of financial transactions. This lets you monitor your account balance better.

- Checks are considered to be a safe choice for payment since they need the account owner’s approval and signature to be considered valid.

Things to Consider While Using a Check

- Always double-check the details like the payee’s name, amount, date before writing a check.

- Ensure that your account holds enough money to cover the amount of check. It will prevent checks from bouncing.

- Post-dated checks are not accepted by bank as checks remain valid only for three months from the date of issue.

- Sign the check in the specified section using your full name. Ensure that your signature matches with the one you provided at the bank.

Ease of Making Payments to Suppliers

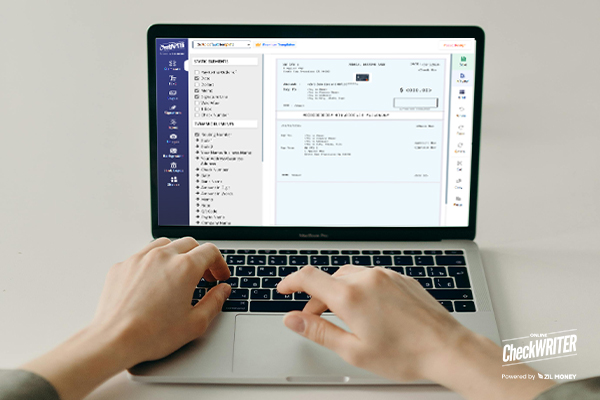

Travel agencies often have to collaborate with various clients including airlines, hotels etc. Zil Money allows to print checks on blank check paper or plain white paper using any printer. These agencies can effortlessly issue checks without the hassle of writing checks manually or using pre-printed checks. Printing checks on blank check paper helps to achieve significant cost savings by reducing the check printing expenses by 80%.

Adaptable Check Creation

Travel agencies can easily create personalized checks that suit their branding with Zil Money. The drag-and-drop design feature from the platform helps to easily add logos, font style and background images to checks. Each check distributed to a customer with efficient branding boosts the agency’s recognition.

How to Customize Checks with the Cloud-based Platform?

- Login to Zil Money and select Bank Accounts.

- Select your bank account.

- Click on Edit Design, which takes you to the check designing page.

- From the check designing page, you can add elements, make necessary changes & click Save.

Quick Customer Refunds

Travel agencies have to handle various client refunds frequently when trips are canceled or changed. With Zil Money agencies can quickly issue refunds using printed checks or eChecks.

eChecks

eChecks function similar to paper checks. The cloud-based platform allows to create, design, and send eChecks to your payees at an affordable price. Agencies have the option to send electronic checks via email or SMS as one-time printable PDF. Customers can print them when it suits them best.

Checks by Mail Feature

For agencies that like to send physical checks, Zil Money provides an easy and cost-effective check mailing service using USPS or FedEx, including postage and paper costs, with same-day delivery. This service lowers the expenses linked to conventional postal services, aiding travel agencies in managing their costs more efficiently.

Integration and Security

Zil Money integrates with over 22,000 banks and financial institutions in the USA and Canada. This connection helps to prevent fake checks from hitting the account. You can also link several bank accounts for your business and use the software to easily reconcile bank data.

Positive Pay

The 2024 AFP® Payments Fraud and Control Survey Report reveals that 80% of organizations experienced payment fraud attacks or attempts in 2023. Checks remain the payment option most at risk of fraud, with 65% of participants noting that their companies encountered this type of fraud. Positive pay feature from Zil Money offers a strong defense against check fraud. This feature allows you to notify your bank in advance about checks you’ve written. As a result of this banks will only accept checks that have been previously reported to them. A transaction occurs when the check’s number, account number, and amount of the issued check match the one presented for payment. Checks that don’t match are sent back to the issuer.

Checkbooks are still relevant even though many digital payment methods are commonplace. It can be used in circumstances when card payments are not accepted. A checkbook register helps to maintain an accurate record of your payment. The traditional way of keeping track of your checkbook, by writing down your expenses and the remaining balance, is a great method for budgeting and monitoring your spending habits.