This article will elucidate how Zil Money is a better alternative to Chax as it offers not just check printing but also a host of other features, making it a better choice when compared to its competitor. We will have a detailed comparison between the two and state how one is better than the other in terms of its fee to its customer service.

What is Chax?

It is a debt collection cum check printing software that allows you to print checks as well as transfer funds via checks through phone, fax, and email. The features offered are limited compared to the plethora of features offered by its competitor. It also does not charge any additional fee for sending money via checks or printing checks.

What is Zil Money?

It is a cloud-based banking service that offers several services such as direct deposits, ACH payments, and wire transfers for nominal fees. It also provides free custom check printing services. Checks can be easily designed using the simple check design interface. They can be printed from the convenience of your home or office using any printer on either blank check stock paper or on regular paper.

Additionally, it lets you send and receive checks using any medium like phone, email, or fax, it also lets you mail checks via USPS for $1. Zil Money guarantees that your check will reach its recipient safely and securely. Its integration with over 22,000 banks makes printing their checks easy. Moreover, you can sync it with third-party software such as Gusto, Zoho and QuickBooks, and so on as well, making it easy to print their checks also.

Zil Money vs. Chax

Zil Money is a comprehensive money management software that allows users to track their finances in a variety of ways. Chax is also a comprehensive money management software, but it is specifically designed for traders. Each software has several features in common, including the ability to create budgets, track spending, and set goals.

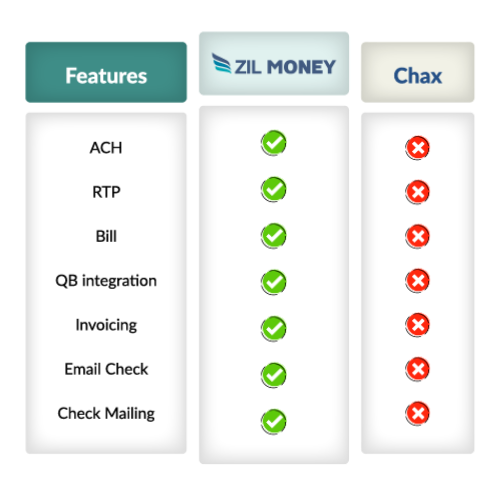

However, the former has several features that are specific to financial planners, such as the ability to operate multiple bank accounts, get a virtual and physical card, send money via ACH, direct deposits, and wire transfers. Overall, the former is a more comprehensive tool than the latter and may be better suited for people who want to manage their entire financial life.

Zil Money has a feature set designed for financial planners. The app is easy to use and comes with a free trial. While Chaxis a more straightforward app that allows users to track their finances and budget. Bottom Line: The free version of the former has a feature set designed for financial planners that is superior to the latter, which comes with a free trial but does not offer the same level of features.

Let us Take a Deep Dive into Zil Money Features

It offers a comprehensive range of features, making it one of the most feature-rich money management software options available. It integrates with a number of financial institutions, including banks, credit unions, and investment firms, so that you can manage your finances from a single platform. It also has a number of features designed to help you save money, such as automatic budgeting and goal-setting tools.

Thus, Zil is comprehensive financial management software that allows users to manage their finances in an organized, easy-to-use interface. One of the main benefits of using it is that it is a cloud-based platform that allows users to access their finances from any device or computer. This makes managing finances more manageable than ever and eliminates users’ need to carry around multiple financial documents.

Another great feature of it is its ability to automatically generate monthly budget reports, which help track spending and optimize spending habits. Chax may also offer similar reports, but they are not as user-friendly or comprehensive.

To sum up the important advantages Zil brings to the table: First, itoffers virtual credit cards for transactions while the latter does not. Second, Zil Moneyoffers more comprehensive features than the latter, including budgeting tools, multiple bank accounts, and 24/7 customer support. Finally, it is less expensive than its competitor overall.

-Chax does not offer automated processing features as the former does, which can make it a more customizable and user-friendly option for smaller businesses.

- Zil also offers a broader range of payment options, including PayPal, Venmo, and Square Cash.

- It offers multiple options to transfer funds like ACH, direct deposit, and wire transfers

- It is integrated with over 22,000 banks and third-party software like QuickBooks, Gusto, and Zoho.

- Its application offers cross-platform support making it easy for customers to access their finances from any device.