Running a business is about making the right moves to keep growing and protect your profits. One of those moves? Pay by credit card. It may seem like just a convenient way to pay, but when used right, it can have a significant impact on the way you handle your finances. So, let’s take a closer look at how pay by credit card feature can positively impact your business’s bottom line.

Click Here To See Interactive Demo⬇

Why Credit Cards? More Flexibility Means More Sales

Boost Your Sales and Cash Flow

When customers or clients have more payment options, they’re more likely to complete transactions. Offering credit cards as a payment method isn’t just about processing payments—it’s about driving growth. Credit card payments are fast, convenient, and trusted, making customers feel more comfortable pulling the trigger on purchases.

With Zil Money, you don’t just have to accept payments—you can pay anyone with your credit card, even if they don’t directly accept cards.

- Pay Anyone with Your Credit Card: Use your credit card to pay vendors, contractors, and government agencies.

- Hold Onto Your Cash: Keep your cash flow while paying on time.

Increase Customer Retention

Credit cards make it easier for customers to pay on the spot, encouraging repeat business. Zil Money lets you pay for any business-related expense using your credit card while earning rewards—cashback, miles, travel points, or whatever works for you. You’re providing a smooth experience for your customers and turning every transaction into a reward for yourself. That’s a double benefit!

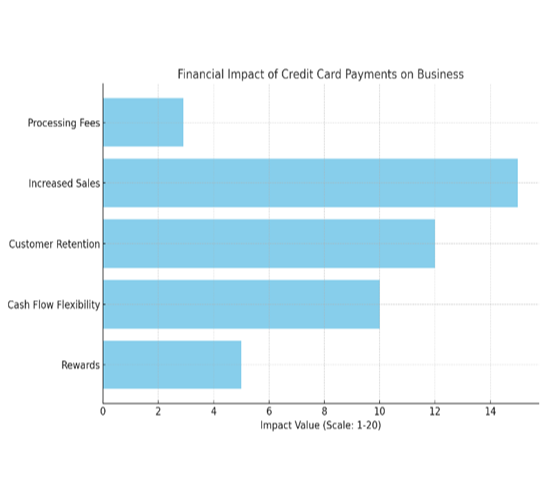

Balancing Credit Card Processing Fees with Increased Revenue

One major issue with the credit card payment acceptance is the processing fees . Most businesses wonder if the cost of credit card fees outweighs the benefits of the increased flexibility. The truth? When managed correctly, the pros far outweigh the cons.

1. Credit Card Fees Explained

On average, businesses pay a processing fee of around 2-4% for each transaction. While this is a cost to consider, it’s important to weigh it against the increased revenue and operational efficiency you gain from offering credit card payments.

Zil Money makes this even easier by offering a transparent fee structure. With just a 2.90% transaction fee and no hidden charges, businesses can easily predict costs and factor them into their pricing structure. And the best part? This fee is tax-deductible, making it an even smarter choice for businesses looking to maximize their savings.

2. The Hidden Revenue

The ongoing cost of credit card processing fees is outweighed by the boost in revenue from higher sales, returning customers, and faster payment processing. The value lies in how offering credit card payments enhances your overall business operations. You may be paying a small fee on each transaction, but the long-term benefits in terms of sales growth, customer retention, and operational efficiency create a much larger return on investment.

Don’t forget the perks of using credit cards for payments. Many cards offer cashback, travel points, and rewards for every dollar spent. Using your business credit card turns regular expenses into rewards, like cashback or miles for business travel.

Is It Worth the Cost?

Here’s the million-dollar question: Are the fees worth it? The short answer: Yes! When you consider the long-term benefits—more sales, faster payments, customer loyalty, and rewards—the small processing fee becomes insignificant.

With Zil Money, you get all the benefits of credit card payments, without the hassle. Plus, the transparent 2.90% fee (which is even tax-deductible!) makes it easy to plan and budget for.

Why Credit Card Payments Are a Business Growth Tool

Credit card payments aren’t just a convenient option—they’re a growth engine for your business. Bring in more customers, simplify your billing processes, and gain full control over your cash flow.

If want to take your business to the next level, it’s time to embrace credit card payments. Switch to Zil Money today and start making smarter, more profitable payments with your credit card.