For American business owners, ensuring the security of financial transactions is important. One crucial element in this process is the account number on the check, a unique identifier that plays a significant role in check security. The account number, acting as a gateway to financial assets, demands careful attention to prevent unauthorized access and potential fraud. Business owners must recognize that the compromise of account numbers can have far-reaching consequences, impacting not only business but also the trust of clients and partners.

The Role of Account Numbers

Identification and Authorization

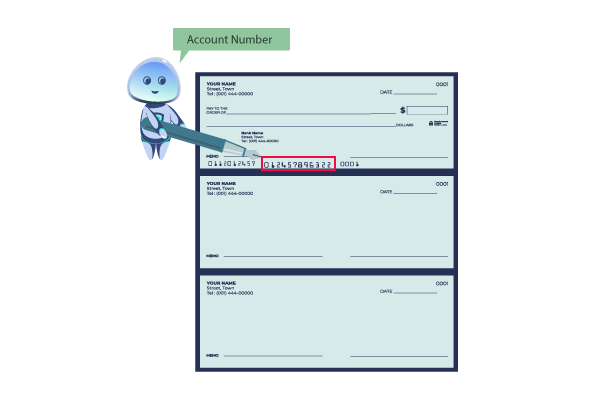

Account numbers serve as a distinct identifier for individual bank accounts. When included in a check, they play an important role in establishing the authenticity of the transaction. Banks use account numbers to verify the legitimacy of checks, ensuring that the funds are drawn from the correct account.

Transaction Tracking

Account numbers facilitate the tracking of financial transactions. They help both the payer and payee by keeping records and monitoring cash flow. By referencing account numbers, businesses can easily reconcile the accounts and identify discrepancies or unauthorized transactions.

Security Measures

The confidentiality of account numbers is crucial for preventing fraudulent activities. Business owners must take measures to safeguard this sensitive information to prevent unauthorized access.

Tips for American Business Owners:

Use Secure Check Designs

Invest in checks with advanced security features such as watermarks, microprinting, and holograms to deter counterfeiters.

Limit Access to Account Information

Restrict access to account numbers within the organization. Only authorized personnel should have access to this information, and it should be shared on a need-to-know basis.

Regularly Monitor Accounts

Regularly review bank statements and transaction histories to detect any unauthorized or suspicious activities quickly.

The importance of account numbers

Zil Money, an innovative platform, offers tools and features that simplify check transactions for business owners. Integrating the platform into one’s financial processes ensures efficient and secure handling of account numbers during transactions. The platform employs advanced encryption protocols to secure sensitive information, including account numbers. The platform provides real-time monitoring capabilities, allowing business owners to stay informed about account activities. The platform’s reporting tools help to regularly review and reconcile the financial transactions. Analyze reports to identify discrepancies or irregularities involving account numbers, allowing for swift corrective action.

In the digital age, where financial transactions are increasingly conducted online, the security of account numbers on checks is of utmost importance for American business owners. By understanding the significance of account numbers and implementing robust security measures, businesses can safeguard their finances and protect themselves from potential threats. Stay vigilant and utilize the available security tools to ensure a secure financial environment for one’s business.