The complexity of traditional payment methods often leads to delays, security issues, and limited control over transactions. The cloud-based platform introduces a transformative solution through its virtual card API. API allows businesses to create multiple cards linked to a single account, offering flexibility and control over customer transactions. This feature provided by the platform empower businesses with innovative and secure virtual payment options for their customers.

Effortless Creation of Unique Virtual Cards

Zil Money’s virtual card API feature makes it easy to create unique virtual cards. API also empowers businesses to create multiple cards linked to a single account. This improves flexibility and oversight of customer transactions. By setting spending limits for these cards, businesses can enhance security measures and prevent excessive spending, thereby ensuring financial stability.

Comprehensive Control and Security

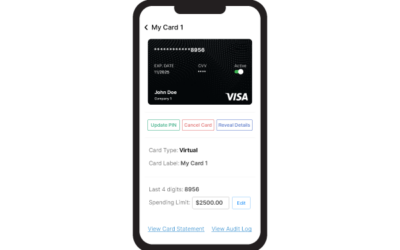

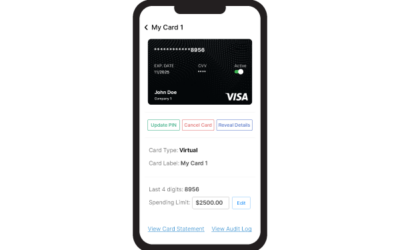

Businesses using the Virtual Card API can benefit from additional security features such as the ability to cancel cards if necessary. This adds another layer of protection against unauthorized transactions. Moreover, the functionality to temporarily lock cards using a mobile app enhances control over transactions. It ensuring a payment experience that is both secure and straightforward.

Secure Online Transactions

Virtual Card API from Zil Money presents an optimal solution for conducting secure online transactions. virtual cards function similarly to physical ones but eliminate the need for a tangible card. This significantly reduce fraud risks. Accessible on mobile devices or smartwatches, virtual cards ensure a smooth payment experience with enhanced security measures.

The cloud-based platform’s virtual card API revolutionizes how businesses approach virtual payments. Payment processes are simplified with features such as simplified card generation, customizable spending caps, and heightened security measures. By utilizing this cutting-edge API, businesses can remain adaptable. The platform provides various payment features, including ACH, wire transfers, and checks, empowering businesses to navigate digital payments confidently. They can prioritize customer needs and thrive in the dynamic realm of virtual transactions.