Virtual card payment has emerged as a transformative force in the realm of digital transactions. These virtual cards are not just a technological upgrade; they represent a significant shift towards simplification, efficiency, and enhanced security in the realm of digital transactions.

Key Benefits of Virtual Card Payments

Virtual card payments provide added security by making each card unique to a specific transaction. This reduces the risk of unauthorized access and minimizes the potential for fraud.

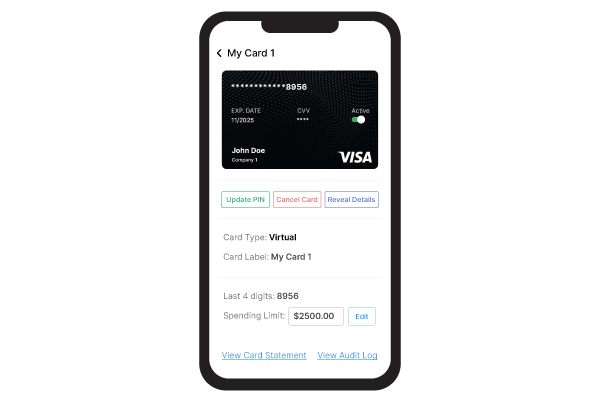

Convenient Expense Management

Virtual cards enable businesses to manage expenses more effectively. They can set spending limits, restrict usage to specific vendors or time periods, and easily track transactions, providing greater control over company finances.

Zil Money’s Contribution to Virtual Card Security

The platform a leading player in financial technology, has emerged as a key contributor to the secure implementation of virtual card payments for American businesses. Leveraging advanced virtual card APIs, the platform ensures that businesses can confidently embrace digital transactions without compromising on security.

The cloud-based platform employs robust encryption protocols to safeguard sensitive financial information during virtual card transactions. This ensures that data remains confidential and protected from potential cyber threats.

Real-time Fraud Monitoring

The virtual card APIs provided by the platform include real-time fraud monitoring capabilities. Suspicious activities trigger immediate alerts, allowing businesses to take prompt action and mitigate potential risks.

The platform stands out with its effortless integration, catering to businesses of all sizes. Whether you’re a startup or a large enterprise, the platform’s virtual card APIs smoothly blend into existing financial systems. This ensures a trouble-free and secure payment experience, benefiting both businesses and clients.

Zil Money’s commitment to enhancing security through advanced virtual card APIs positions it as a reliable partner for American businesses seeking to strengthen fraud prevention measures. By embracing the efficiency and security offered by virtual card payments, businesses can pave the way for a more secure and enhanced financial future.