SOC 1 Certification

Reduced risk of financial misstatementsSOC 2 Certification

Data integrity assurancePCI DSS Compliance

Protection against data breachesISO 27001 Certification

Risk-based approach to securityISO 20000 Certification

Efficient service delivery processesISO 9001 Certification

Customer-centric operationsCCPA Compliance

User control over personal dataNIST 800-53 Compliance

Federal-level data protectionHIPAA Compliance

Privacy protection for patient dataTrusted by Businesses Nationwide

$100B+

Transaction volume

1M+

Active businesses

99.9%

Uptime SLA

67%

Average expense reduction

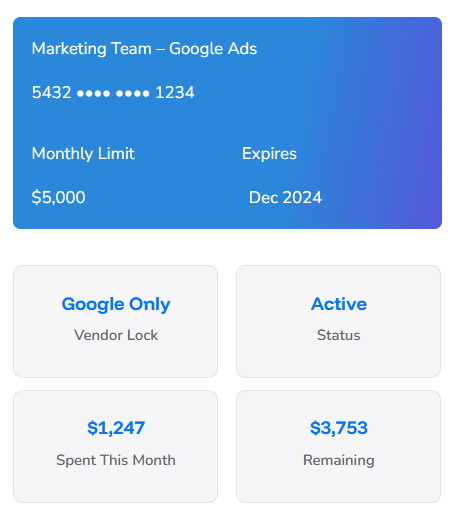

Create cards that work exactly where you need them.

Marketing gets a Google Ads card that only works for Google. Your contractor gets a Home Depot card that only works at Home Depot. Every card has a purpose. Every purchase is intentional.

✔ Instant card creation from your Zil Money wallet

✔ Automatic spending limits and vendor locks

✔ Apple Pay and Google Pay integration

✔ Real-time transaction alerts and controls

Shared business cards create problems

When multiple people use the same card, spending gets messy. Someone always buys something they shouldn’t.

Nobody knows who bought what

Five people share one card. Someone bought $200 of “office supplies” on Amazon. Was it printer paper or a personal purchase? You’ll never know for sure

Universal problem for any shared card

← ••• →

People buy things you didn't approve

You said “buy printer paper” but they also grabbed lunch, coffee, and phone chargers. When everyone has the same card, “approval” becomes meaningless.

Happens to every business with shared cards

← ••• →

One fraud incident locks everyone out

Someone uses the card at a sketchy website. Now the whole team’s card is frozen. Work stops. Everybody waits 5-7 days for replacement cards.

Business disruption affects everyone

← ••• →

Every person gets their own card.

Every card has one job.

Create New Cards Instantly

Need a card for a new vendor? Create one in a few minutes from your Zil Money wallet. Unique card number, instant Apple Pay and Google Pay integration, ready to use immediately.

In minutes vs 5-7 days for traditional cards

← ••• →

Cards That Only Work Where You Want

Create a card for Google Ads—it only works for Google. Create a card for office supplies—it only works at Office Depot. Want to buy something else? The card gets declined.

Impossible to buy the wrong things

← ••• →

Every Transaction Tells You Exactly What It Was

Automatic receipt capture via SMS. AI categorizes every expense. Real-time sync with your accounting software. You always know exactly what was purchased and by whom.

No more mystery purchases

← ••• →

Pay Global Teams

Issue cards for international contractors and remote teams. Experience 24/7 support and regional spending controls

Works in 50+ countries

← ••• →

One Card Gets Compromised? The Others Keep Working

Each card has unique numbers. If someone’s marketing card gets compromised, everyone else keeps working. Instantly create a replacement. No business disruption.

Zero downtime from fraud

← ••• →

See Every Dollar in Real-Time

Live spending dashboard. Instant alerts for every transaction. Budget tracking by team, project, or vendor. Complete spend transparency.

Real-time insights, not month-end surprises

← ••• →