A credit memo, also referred to as a credit note, is a financial instrument that a seller provides to a buyer, offering a credit against the balance owed for goods or services previously purchased. Preparing a credit memo can be quite challenging, but that’s where Zil Money comes in to help. Our platform offers an easy way to generate credit memos from anywhere, whether at home or in the office. Keep reading to know more about credit memo and how Zil Money can help you.

Understanding Credit Memo

A seller will send a buyer a credit memo, also known as a credit memorandum. After an invoice is sent, the buyer receives this document. A credit memo can either lower or completely cover the cost of a buyer’s purchase item. When a seller issues a credit memo, it is applied to the buyer’s account’s current balance to lower the overall amount. A refund is distinct from a credit memo. When a customer gets a refund from a retailer, they actually get their money back. Our skilled accountants can assist business owners with fundamental duties like sending invoices, maintaining sales records, and issuing credit memos. When business owners outsource their accounting work to Ignite Spot, they have more time to focus on growing their company’s profits.

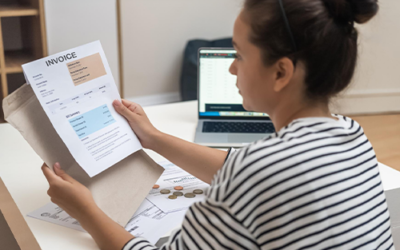

What Kinds of Information Are There in Credit Memos?

There are several significant pieces of information in a credit memo. The purchase order (or PO) number, along with the payment and billing terms, are typically included in credit memos. Other crucial information on a credit memo includes the shipping address, a list of the items, the prices, the number of each item, and the date of purchase. A seller can keep track of inventory with the help of all of this data. The justification for issuing the credit memo is also included in this document.

When to Issue a Credit Memo?

Credit memos are generated when a customer returns an item, or a business is owed a refund for another reason.

When a vendor sends you a credit memo, it indicates that the vendor has credited your account. This takes place when you return an item to the seller, or the seller owes you a refund for some other reason.

When you give a customer a credit memo, you effectively give them credit. This occurs when a customer returns an item to you or when you otherwise owe the customer a refund.

Benefits of using Credit Memo

- Correcting Errors: One of the most common uses of credit memos is to correct errors in invoices. If an invoice is issued for an incorrect amount or pricing, a credit memo can be issued to adjust the balance. This helps to ensure that the customer is charged the correct amount and that the business’s financial records are accurate.

- Managing Accounts Receivable: Credit memos are an important tool for businesses to manage their accounts receivable. By accurately tracking credit memos, businesses can ensure that their financial records are accurate and up-to-date. This can also help to prevent disputes with customers and maintain good relationships.

- Reducing Disputes: Issuing a credit memo can help reduce customer disputes. If a customer has a problem with a product or service, issuing a credit memo can help to resolve the issue quickly and fairly. This can help build customer trust and loyalty, which can ultimately benefit the business in the long run.

- Improving Cash Flow: Issuing credit memos can help to improve cash flow by reducing the amount owed by customers. This can help to free up cash that can be used for other business expenses or investments.

- Enhancing Customer Satisfaction: Issuing credit memos can help to enhance customer satisfaction by resolving issues quickly and fairly. In addition, this can help build customer trust and loyalty, which can lead to repeat business and referrals.

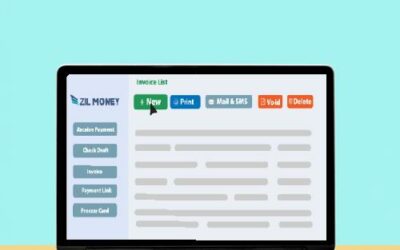

How are Credit Memos Created with Zil Money?

Credit memos can be created manually or automatically, depending on the accounting system used. Usually, the credit memo is created in the same system used to create the original invoice.

You can also create credit memos automatically. Again, Zil Money is the best platform for creating credit memos.

The credit memo function of Zil Money can save you a lot of time.

Steps in Zil Money:

First, click on the credit memo, select the customer, and add the credit amount. Then, when you issue an invoice to this customer next time, it reminds you automatically of the credit you added to apply either in full, in part or to extend to the next invoice.

Credit memos are an important tool for businesses to manage their accounts payable and receivable. They are used to correct errors, adjust balances, and maintain good customer relationships. Create credit memo using Zil Money, if you’re looking for an efficient and automated way to create credit memos, Zil Money is the perfect platform for you. With Zil Money, you can easily generate credit memos without the hassle of manually preparing and recording them.