When it’s about handling your money, it’s essential to know the different parts of a check, and among the key parts is the routing number. For U.S. businesses, the routing number is crucial for various tasks, such as setting up direct deposits, making vendor payments, and handling payroll. Knowing how to find and use routing numbers on a check can make financial transactions easier, improve cash flow management, and lower the chances of mistakes.

Click Here To See Interactive Demo⬇

Understanding Routing Number

The financial network in the United States is deeply linked and routing numbers are vital components of financial infrastructure that help to distinguish one bank from another. They facilitate the swift movement of funds and allow you to carry out various transactions. This figure is essential to ensure that funds are directed to the right bank during a transfer.

Routing numbers are also referred to as ABA numbers. These numbers were introduced by the American Bankers Association in the year 1910. At first, routing numbers were created for the purpose of making paper check processing more efficient. Now they are extensively used to support various electronic transfers including Automated Clearing House transfers. Each routing number is unique to a financial institution and in some instances, it can also refer to a specific branch or area of the bank.

A Breakdown of the 9-Digit Code

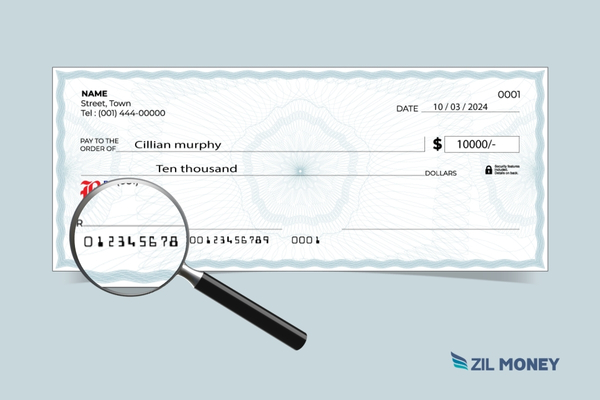

An ABA routing number consists of nine digits which are divided into three parts.

- The initial four digits represent the Federal Reserve Routing Symbol

- The next four digits help to identify the ABA institution

- The last digit is check digit which prevents transaction errors.

How to Locate a Routing Number?

Checkbook: Routing numbers are normally found in the lower-left corner of your checks.

Bank Statement: Financial institutions often include routing numbers in customers monthly statements.

Bank Website or Mobile App: Most banks list their routing numbers online.

Contact Customer Service: If you’re not sure, you can call your bank’s customer service for assistance in getting the correct routing number.

Making Check Management Easier for U.S. Businesses

When business make payments using check, the routing number ensures that money goes to the right bank. This is especially critical for organizations that engage in transactions with multiple institutions. Zil Money makes this procedure easier by allowing businesses to quickly print checks with routing numbers, making their payment processes more efficient.

Key Benefits for U.S. Businesses

- Zil Money enables U.S. companies to create checks that include all the relevant information, such as account and routing numbers. The platform provides the option to print checks on blank check paper or plain white paper using a regular printer.

- Printing checks on blank check stock helps to achieve significant cost savings up to 80%. This eliminates the need to purchase expensive pre-printed check stock and allows to print checks as needed.

- The cloud-based platform provides excellent customization options that help businesses to strengthen their brand identity. The drag-and-drop design feature from Zil Money allows you to easily add background images, font style, digital signatures etc.

- Businesses frequently need to make large payments, such as payroll or vendor payments. The check printing software helps businesses manage these payments easily. Instead of writing checks manually, firms can quickly generate multiple checks in just a few minutes, including routing numbers.

- For businesses, keeping finances safe is very important. Zil Money makes sure that every piece of financial information such as routing numbers and account information, is handled securely. This helps reduce the chances of check fraud and other security problems that might occur when using regular checks.

- After creating the check US businesses have the option to dispatch it as eChecks or through traditional mail. eChecks are digital versions of traditional paper checks. The platform allows to send electronic checks as one-time printable PDFs through email or SMS.

- Zil Money offers checks by mail feature at an affordable rate covering postage and paper costs with same day delivery through USPS or FedEx. Enjoy a stress-free experience as the platform takes care of printing, labeling, enveloping, and mailing your check all on the same day.

Routing vs Account Number

The routing number shows the name of the bank in which your account is located, while the account number, which is usually eight to twelve digits long, identifies your specific account. If you have two accounts at the same bank, the routing numbers will be the same, but the account numbers will be different. Both numbers are essential for ensuring the money is deposited correctly and on time. Any error in giving the right numbers can lead to delays and expensive charges.

Understanding the concept of routing numbers is vital for anyone who deals with financial sector. These nine-digit numbers prevent mistakes and delays, and ensure that deposits and payments reach their correct destinations. As technology advances, routing numbers continue to be essential, highlighting their importance as a fundamental component of our financial system. By learning about these numbers, you can take control of your finances and make better choices in today’s busy financial world.