Reconciling bank accounts provides a comprehensive overview of daily financial activities, facilitating efficient budget management. By categorizing transactions regularly, individuals can consolidate income and expenses for enhanced financial organization. This systematic approach simplifies monthly transactions and empowers individuals to identify opportunities for significant cost savings. This ultimately boosts profitability through the reduction of unnecessary expenses.

Detecting Errors and Fraud

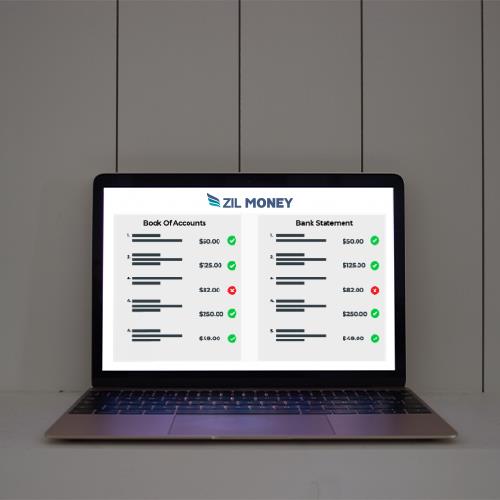

Regularly comparing your bank statements helps in detecting accounting errors, duplicate payments, incomplete payment records, and possible fraudulent activities. The reconciliation feature provided by Zil Money facilitates users in efficiently comparing information, easily detecting and resolving inconsistencies. Through this approach, the platform ensures the precision of financial transactions and quickly addresses any discrepancies, thereby upholding financial integrity.

Tracking Cash Flow

Zil Money provides robust features for tracking and analyzing cash flow, which is essential for financial management. Users can monitor income and expenses, categorize transactions, set budgets, and generate detailed reports. This enables informed decision-making and optimization of cash flow trends. With real-time data and insights, the platform supports users in managing finances effectively, whether for freelancers, startups, or established organizations.

Ensuring Financial Accuracy

Bank reconciliation protects against fraudulent behavior and accounting irregularities. Discrepancies can be identified and corrected by comparing recorded data with actual transactions, ensuring the accuracy of financial records. Zil Money’s monthly reconciliation procedure offers extensive analysis, enabling users to maintain accurate financial records and minimize potential liabilities.

A key component of financial management is effective reconciliation, which guarantees precision, openness, and defense against fraud. By utilizing the cloud-based platform’s sophisticated bank reconciliation feature, both individuals and businesses can easily identify issues, optimize cash flow management, and enhance their financial processes. Harness the efficiency of the platform’s feature to effectively manage your finances and gain peace of mind. This enables users to focus more on strategic financial decision-making.