Running a small business is tough enough without having to follow up on unpaid invoices. Yet, many business owners still spend hours sorting emails, creating manual payment records, and juggling different platforms just to keep invoicing on track. The real question is: Why is something so essential still this difficult? Invoice Management shouldn’t feel like detective work. But for many, it does.

Here’s why:

- Clients often claim they never received the invoice.

- There’s no centralized space to send, manage, and follow up on invoices.

- Invoices are manually typed, saved in folders, and emailed without confirmation.

- Payments come through scattered channels, making reconciliation slow and confusing.

These pain points turn a straightforward task into a daily headache—eating up time, energy, and momentum.

Click Here To See Interactive Demo⬇

When Late Payments Become a Pattern

According to QuickBooks research, 73% of small and medium-sized businesses in the U.S. are hurt by late or extended invoice payments. About 62% face moderate challenges, while 11% experience serious financial strain.

These delays don’t just affect cash flow. They interfere with payroll, vendor relationships, and overall business planning. A few late invoices can derail operations—making it hard to move forward confidently.

One Platform That Brings It All Together

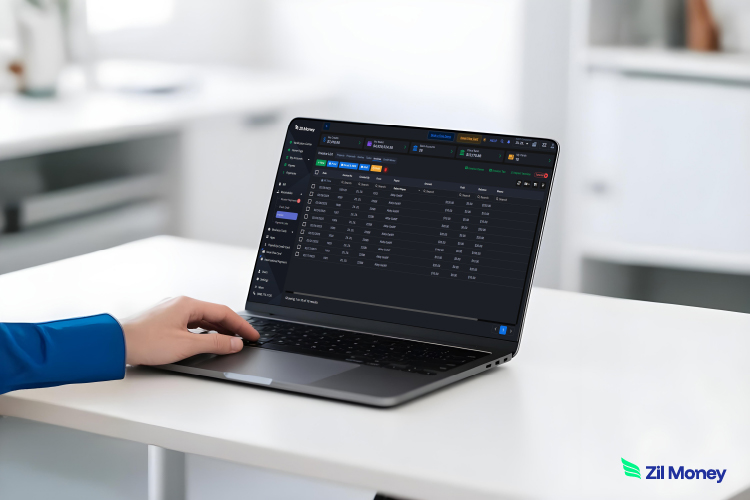

Zil Money simplifies invoice management by allowing small businesses to generate and send digital invoices in just a few clicks. From entering invoice details to sharing them via email or SMS, the entire process happens in one clean, easy-to-use dashboard.

No more toggling between tools, chasing unpaid amounts, or formatting invoice PDFs. With a few entries, business owners can send payment requests that support multiple payment methods—all while keeping communication clear and professional.

Making the Process Easier – Feature Highlights

1. Access Invoicing Tools Anywhere

Create and send invoices from desktop, tablet, or phone—whether you are at your desk or on the move. Everything stays synced, so you are never tied to one location.

2. Easy Payment Collection

Each invoice offers multiple ways to pay—like ACH, credit card, printable checks, or eChecks—so clients can choose the option that works best for them.

3. No More Manual Logs

Payment records are automatically updated, and reports are exportable—saving hours that would have gone into spreadsheet updates.

Why The Platform Works for Small Businesses

- No Overhead Tools Needed: Everything happens in one place—no extra apps, downloads, or installations.

- Supports Multiple Payment Methods: Send invoices attached with payment links so clients can pay however they choose.

- Mobile-Friendly Access: Business owners can create, send, and manage invoices from anywhere—on any device.

Invoicing Is Becoming a Top Priority for U.S. Businesses

The U.S. e-invoicing market was valued at approximately $3.85 billion in 2024, and it’s projected to grow to $19.14 billion by 2033. This sharp growth (at a compound annual growth rate of 18.2%) is driven by demand for faster transactions, cleaner records, and wider adoption of cloud-based tools across finance, logistics, and tech.

This shift shows that more business owners are done with clunky, outdated invoicing systems. They want clarity, speed, and simplicity.

Who’s Using It—and Why It Works

- Event Planners

Settle supplier costs, venue fees, and service charges without waiting on manual approvals.

- Creative Agencies

Bill for projects or retainer services while giving clients an easy way to pay—no matter their preferred method.

Looking Ahead: Why Thoughtful Invoicing Matters

Digitizing invoice management isn’t just about sending payment requests—it’s a strategic decision. Businesses that adopt faster, cleaner systems free up time to focus on service, delivery, and customer relationships.

Invoicing may not be glamorous, but it’s the thread that holds together cash flow, trust, and growth. A smoother system means fewer delays, better forecasting, and more space to lead.

If business owners want to be more responsive, more reliable, and more scalable—they need tools that do the heavy lifting behind the scenes.

Ready to Make Invoicing Simple?

If your current invoicing process still feels clunky, slow, or scattered, it’s time to rethink the tools. An easier setup means fewer mistakes, faster payments, and more time spent doing the actual work—not chasing it.

Simplify the way you bill with Zil Money—a smarter way to manage invoices and get paid without the stress.

Streamline your process. Save your hours. And let your business breathe easier.