Every financial transaction involving a bank needs two important pieces of information to identify the customer: the routing number and the account number. Both of these are given to you when you open an account. There are many check printing platforms for you to print routing, check and account number on check.

What Is a Check?

Checks order banks to pay their owners. The “payer” or “drawer” writes the check. The “payee” receives the check. Checks are easy to cash or deposit into a bank account. The payer and payee can benefit from their transaction record. Checks are legal documents, so handle them carefully.

Account Number

An account number is a unique string of numbers and, sometimes, letters and other characters that show who owns an account and gives them access. The account number is usually between 8 and 12 digits long. If you have two accounts at the same bank, the routing numbers will usually be the same, but your account numbers will differ.

What Is a Checking Account Number?

Your checking account number tells the bank what account you have and where it is. This number tells your bank where the money meant for you should be deposited or taken out. You’ll need to give this number whenever you set up a payment method, like direct deposit or a payment app.

Routing Number

The routing number sometimes called an ABA routing number after the American Bankers Association, is a string of nine numbers that banks use to identify specific financial institutions in the U.S. This number shows that the bank is either federally or state-chartered and has a Federal Reserve account.

Most small banks only have one routing number, but large multinational banks can have several, usually based on the state where your account is. Routing numbers are often needed when reordering checks, paying bills, setting up direct deposit (like a paycheck), or paying taxes. The routing number will be different for domestic and international payments. The routing number will be different for domestic and international payments.

Routing Number vs Account Number

If you want to set up a direct deposit, like your paycheck, or order checks online, you will need both your account and your bank’s routing numbers.

Account numbers are similar to customer IDs or fingerprints in that they are unique to each person with an account. Routing and account numbers are given to clarify where money is coming from and going in a transaction.

In the same way, routing numbers give each bank a unique number that can be used to find it. For example, when you make an electronic funds transfer, you must provide the financial institution with routing and account numbers.

Routing numbers always have nine digits, and account numbers usually have between nine and 12 digits, though they can be longer sometimes.

How to Locate Your Account Number?

An account number is a unique identifier for each account at a bank or other financial institution that you have. Along with the routing number, this number is used to make payments and deposits. Due to the increase in identity theft and fraud, it is important to protect your account number and other banking information.

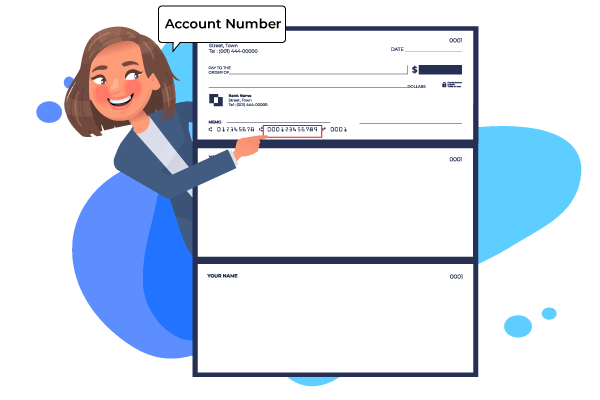

How Do You Find the Account Number on Check?

At the bottom of your paper check, you can find your bank account number on check. This is the second set of numbers between the nine-digit routing numbers. The check number can sometimes be written in a different spot. Choose the longer number to find out what your account number is. This number is private and unique to your bank account. You can only find it on your checks or by logging into your online account. You can also find this number on your account statement.

Use Zil Money to print routing, check and account numbers on check instantly on-demand and save time and money.

An account number is a unique identifier for each account you have at a bank or other financial organization. This number and the routing number are used to make payments and deposits. Safeguard your account number and additional banking information. Print your account number on check using Zil Money without wasting your time. So, why wait? Signup to Zil Money today and enjoy check printing!