A routing number is a nine-digit number that serves as an electronic address for a bank in the United States and helps to make transactions between financial institutions. Just like individuals have Social Security Number or Taxpayer Identification Number, banks have a unique identification number called routing numbers, aka ABA (American Bankers Association) routing number.

Bank routing numbers are essential for transactions like ACH or direct deposit, as it helps banks recognize and identify the financial institution and transfer funds to the correct account and bank. Additionally, a bank routing number also helps in making transactions more secure. Merchants and contractors can verify the money routes to the right bank. These numbers are issued only to federal or state chartered financial institutions eligible to maintain an account at Federal Reserve Bank.

The routing number is integral to securely make transactions from one bank to another. Inaccurate, incomplete, or missing routing number information can cost your enterprise thousands of dollars every month.

What do you need the routing number for?

At one point, you may have been asked by your employer or biller to provide your bank’s routing number with your account number. Your bank’s routing number is required for making certain transactions, such as wire transfers or ACH transfers.

You might need to provide your bank routing number for the following types of transactions

- Wire Transfers

You must fill in your bank routing and account number to send and receive international and domestic wire transfers.

- ACH deposits

Your employer might ask for the routing number and account number for signing up for direct deposit at work.

- IRS Direct Deposits

The IRS will allow you to receive tax refunds faster through direct deposit to your account via ACH by providing your account routing and account numbers.

- Paying Bills

Paying bills online through payment apps like Venmo and Zelle, you will require to provide your bank routing number and account number to give the mobile app access to your bank account.

- Making deposits to retirement accounts or transfers to other banks

When you invest money for retirement, your retirement plan provider will ask for your routing number and account number to use ACH deposits to transfer your money from your bank to your retirement savings each month.

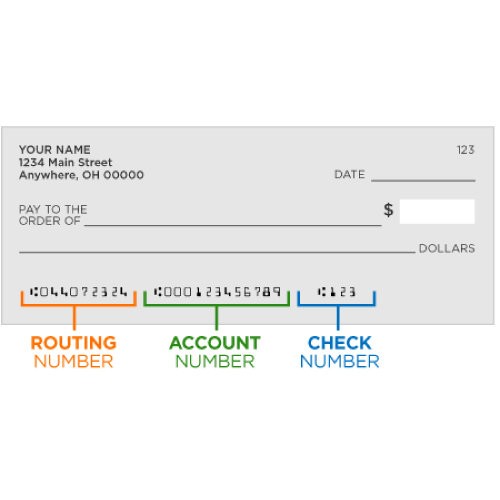

How to find your Routing Number on Check

The routing number is printed on the bottom line of your check, along with your account number and check number. Banks issue checkbooks when you open a savings or checking account; each has a string of nine numbers printed at the lower left corner of every check alongside the account number and check number.

Every check printed at the same bank branch will have the same routing number in the MICR line. The MICR line is the sequence of numbers printed at the bottom of your check in special fonts.

How to find your Routing Number without your check

In case you want to look for your bank ABA routing number and do not have a checkbook handy, you can look for it elsewhere like:

- Bank statements

The bank statements issued at the end of every month will include the ABA routing number as part of the account information sent by mail or paperless electronic statements.

- Bank Website

Every bank has its routing number provided on its website or mobile app.

- Call your bank

You could also call your bank to inquire about your routing number with the helpline service available.

- ABA Routing Number Lookup Tool

You can locate your bank routing number on the American Bankers Association website at ABA Routing Lookup Tool

Bottom Line

A routing number is an electronic address of your bank. It is printed at the bottom of each check in the MICR line and can be used to make international Wire transfers and direct deposits via ACH. Zil Money provides all-in-one finance software to pay and get paid by ACH, Wire transfers, printable checks, eChecks, and RTP. Sign up on our platform and link your bank account to print your checks online and send them as one time printable check or eCheck. Moreover, you can seamlessly keep track of cash flow, manage payroll, and make international and domestic money transfers on the platform from your mobile or desktop.