Employees like yourself no longer have to worry about providing a paychecks because there is a better option, direct deposits. Direct deposit has progressed from a perk to the norm for the majority of workers over the last two decades. However, just because direct deposit is widely used does not mean that it’s perfect, it has its own share fair of drawbacks. So it’s a good idea to make sure you know what to expect and how to get the most out of it. Using our platform, you can now manage and send your payroll from a single location.

Electronic Fund Transfer (EFT) Overview

An electronic fund transfer, or EFTS, is when you use a computer to move money from one bank account to another. They can be done completely without any help from bank employees. Since these are digital transactions, there is no need for paper records.

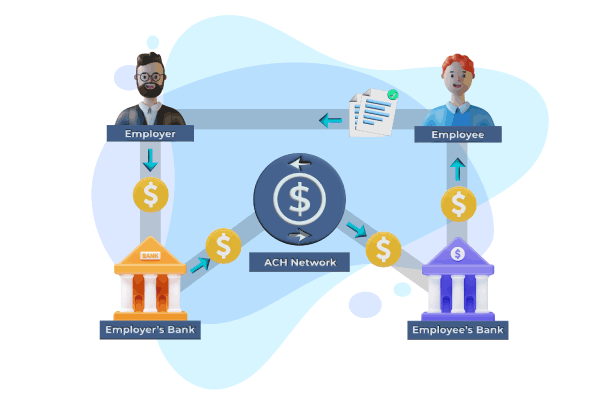

For EFT payments to work, there must be a sender and a receiver. When the sender agrees to send money to the receiver, the money is moved from the sender’s account to the receiver’s account through the right payment network. Use different EFT payment methods to send money.

Direct Deposit

The term “direct deposit” refers to the electronic deposit of funds into a bank account as opposed to the use of a paper check. Direct deposit requires an electronic network that facilitates interbank deposits. This is referred to as a “automated clearing house” (ACH). Because the funds are transferred electronically, the recipients’ accounts are automatically credited; there is no need to wait for the funds to clear.

Benefits of Direct Deposit

Direct deposits are used for a variety of purposes, the most common of which is to deposit paychecks, government benefits, tax refunds, and other items.

You do not have to queue at the bank, wait for a check in the mail, or collect anything when you receive money this way.

Everything is done electronically and faster than ever before – most direct deposits arrive in your account within one to two business days

Is Direct Deposit Safer Than a Check?

Cash or a paper check can be lost or stolen, but a direct deposit can’t. Also, someone could cash a check that wasn’t made out to them. If you misplace a paper check, the issuer will almost always charge you a fee to replace it. If your check is stolen, obtaining a stop payment from your payer can be time-consuming and costly.

Direct deposits have none of these potential security issues. Money cannot be lost or stolen because it is transferred automatically from the payer’s account to yours. Admittedly, the Social Security Administration boasts that not a single direct deposit payment has been lost since 1976, when beneficiaries were first given the option to receive direct deposit.

ACH and Direct Deposit

An ACH transfer works the same way as a direct deposit, which is to say that it is done electronically. We use less cash and checks because of them. Since direct deposits are just one type of ACH deposit, any money that goes into your bank account is both an ACH deposit and a direct deposit.

Since direct deposits is just one type of ACH deposit, any money that goes into your bank account are both an ACH deposit and a direct deposit.

Now you can send money via ACH and direct deposit with Zil Money and manage all your payroll in a single platform.

Disadvantages of Direct Deposit

Employers and employees both benefit from direct deposit. But there are a few things that could go wrong.

For the Company, the Cons of Direct Deposit Include:

- You cannot halt payment as you would with a paper check.

- If an employee’s bank changes, which also changes their direct deposit information, they must complete new authorization forms.

- Setting up financial accounts and setting up a direct deposit system might come with a few costs at first.

- The company must put in place security measures to keep the bank routing and account numbers of its workers safe.

For the Employee, the Cons of Direct Deposit Include:

- Even though it doesn’t happen very often, when an employer asks an employee for bank information that will be added to the employer’s database, it gives hackers another way to get into the employee’s bank account information.

- If an employee changes banks, they have to update their direct deposit information, which means they have to fill out new authorization forms.

- When changing banks, the employee must keep their old account open until the new account receives deposits, which can take several weeks.

- Before writing checks against the deposit, the employee should ensure that the funds have been electronically deposited and are available in their account, just as they would with a paper check.

When weighing the pros and cons of direct deposit, most businesses conclude that the pros outweigh the potential cons. Payroll checks are less efficient than direct deposit. You can use Zil Money to easily set up direct deposits and manage all of your business banking needs in a centralized location. Direct deposit is a simpler, more reliable, and more direct way to get paid, so it benefits everyone involved.