Empowering Growth – One Transaction at a Time

1M+

online business

accounts

100B+

transaction

value

16M+

checks

processed

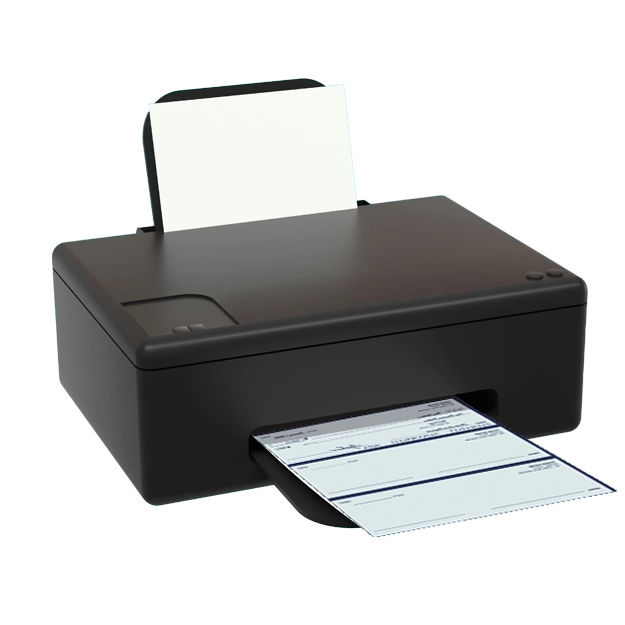

No More Check Orders

Need a check now? Print it instantly from home using any device, whether it’s a desktop, tablet, or smartphone.

Click Here for an Interactive Demo

Branded Checks in No Time

Customize your checks with ease. Add logos, select fonts, and apply backgrounds in seconds using the drag-and-drop tool.

Print Checks with Any Printer

Print professional checks with your regular printer. Use blank check stock or plain white paper, and the platform will ensure they meet bank-approved standards.

Why Zil Money!

A technology-first approach

to payments and finance

Easy to Access

High Security

Easy Payment

Keep Your Checks Secure

Your checks remain safe with built-in security measures. Encryption, authentication, and fraud prevention tools like positive pay keep your transactions secure.

Frequently asked questions

Every Customer Review

is a Story of Trust

Cory Edwards

Owner Edwards Holdings Realty

The most helpful part is that Zil money can be used by everyone. It's very easy to navigate. THE USER INTERFACE is very easy to learn. It solves the problem of having various accounting software separately and unable to integrate. It allows all organization seamlessly.