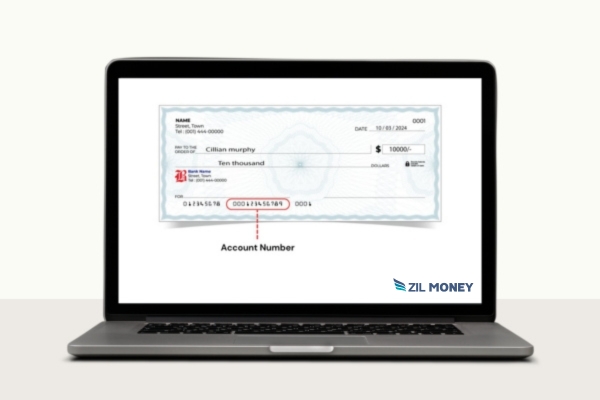

Though checks might seem like an ordinary paper, it is not just that. It is the key to your financial kingdom since it contains sensitive information like your bank account number, routing number, etc. If they got into any wrong hands, these details could be misused. So, it is important to protect checks, particularly in institutions handling a high volume of payments, like academic institutions.

Imagine a school with ten to fifteen teachers and one or two other staff members. Each month, the institution has to issue checks for salaries and other expenses. The problem with using checks is that sensitive financial information on your checks can be leaked if you have not taken proper security measures. This can result in unauthorized transactions or even financial fraud.

For instance, if you are still using traditional check payment methods, there is a high possibility of your checks being lost in transit. This is because traditional methods need you to order pre-printed checks from third parties. Here, your checks may get lost even before it reaches you.

Another fraud attempt that can happen to you if you are using the traditional check payment method is that your checks may be copied. Sometimes, fraudsters may even create a fake check and present it to your bank for payment.

Click Here To See Interactive Demo⬇

Practical Solutions to Safeguard Check Transactions

With Zil Money, academic institutions can prioritize check security, protect their financial operations, and build trust with their stakeholders. The two “P’s” on the platform make sure that your checks are not stolen or misused by anyone. The first P is printing, and the second P is positive pay. The printing feature allows you to safeguard your check by reducing the time spent by your check in transit and eliminating the need to store the pre-printed checks. On the other hand, positive pay ensures that no checks are processed without your knowledge.

How do The Two P’s for Check Security Work?

-

Printing

As mentioned before, this feature helps to avoid fraud by letting you print checks on-demand, thereby eliminating the need for storing pre-printed checks and reducing the time taken by your checks in transit. For this feature to work, all you have to do is buy some blank stock papers and log in to your Zil Money account. Printing checks on blank stock papers can save 80% of check printing costs compared to ordering pre-printed checks. You can either import checks directly from your accounting software or manually create a check.

The platform even allows you to customize your checks by letting you add elements like company logo, font, etc. Even this customization can also act as a security feature as it allows you to add watermarks and signatures on your checks. These elements make your checks irreplicable and hard to counterfeit.

-

Positive Pay

Positive pay is a measure for the prevention of fraud perpetrated through check alteration. It works by ensuring that the details in the check issued by the company match the details in the check presented to the bank. For instance, an academic institution may safeguard their checks with positive pay by giving their banks a list of approved checks before they are presented for payment. This list includes details of checks such as check number, account number, and more.

Each time when the bank receives a check from the institution’s vendors, they will match the check presented with the list already provided. If any check that is not on the list is presented, it will be informed to the institution, and they can decide whether to accept the check or reject it.

Multiple Payment Solution

With Zil Money, an academic institution can pay their vendors via ACH, wire, credit card, eChecks, and many more. All these payment options are completely secure and affordable. The platform offers same-day ACH, which ensures that your payment reaches by the next business day. Wire transfers from the platform can be sent both within the US and outside of the US. This ensures that you can make your payment no matter where the destination is.

The credit card feature from the platform allows you to eliminate interchange fees. Here, the platform receives your credit card payment and then sends money to your payee via the method chosen by you. This way, you may earn your credit card rewards without worrying about the transaction fees your payee has to pay. Finally, the eCheck feature on the platform allows you to send your checks instantly as one-time printable PDFs via email or SMS. The person receiving your check can print it and use it like a regular check.

Your One-Stop Solution

Zil Money is an all-in-one platform where you have the answer to almost all your problems. The platform is integrated with over 22,000 banks and financial institutions, which makes your bank reconciliation process much easier. Presently, more than one million users have simplified their payment operations with the cloud-based platform. Moreover, the platform has crossed $85 billion in processed transactions, showcasing its reliability and scalability for organizations of all sizes.

Conclusion

Academic institutions using checks can safeguard their essential financial data like the bank account number, routing number, and more using Zil Money’s positive pay feature and printing feature. Both features ensure that nobody creates a fake copy of your checks. In short, adopting Zil Money as your payment management platform protects your financial operations and ensures the long-term integrity and security of your institution’s transactions.