In today’s global economy, financial transactions happen daily across borders and between institutions. Banks and financial institutions like Zil Money use the American Bankers Association number, or ABA number, to ensure that these transactions are processed accurately and efficiently.

What is ABA Number?

The ABA number is a unique nine-digit identification number assigned by the American Bankers Association to each bank in the United States. This number is also known as a routing number, which indicates the financial institution that holds the account and facilitates the transfer of funds. The ABA number is used primarily for domestic transactions within the United States and is required for all electronic funds transfers (EFT), including direct deposit, bill payments, and wire transfers.

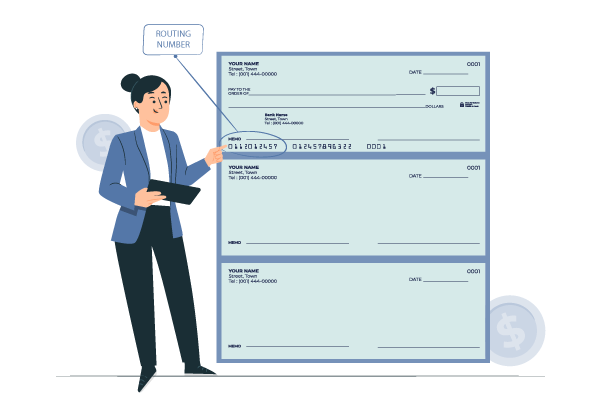

Where to Find ABA Number?

The ABA number is typically printed on a person’s paper checks, along with the account number and bank’s name and location. Users can print account numbers, routing numbers, check numbers, etc., with Zil Money. It can also be found on a person’s online banking account or by contacting the financial institution’s customer service department. Alternatively, the Federal Reserve Bank maintains a database of ABA numbers that can be searched by bank name, location, or routing number.

ABA Number vs. IBAN

While the ABA number is used primarily for domestic transactions within the United States, the International Bank Account Number (IBAN) is used for international transactions between countries. The IBAN is a unique identification code that contains up to 34 alphanumeric characters and includes the country code, bank code, branch code, and account number. The purpose of the IBAN is to help facilitate cross-border payments and ensure that the funds are routed to the correct account.

The main difference between the ABA number and IBAN is the length and structure of the identification code. While the ABA number is only nine digits, the IBAN can be up to 34 characters long. Additionally, the IBAN contains more detailed information about the bank and account, whereas the ABA number only identifies the bank. Finally, the IBAN is used for international transactions, whereas the ABA number is only used for domestic transactions within the United States.

Conclusion

In summary, the ABA number is a crucial component of the U.S. financial system, allowing for efficient and accurate processing of electronic funds transfers. By understanding the importance of the ABA number and where to find it, individuals and institutions can ensure that their financial transactions are processed smoothly and without error. While the IBAN serves a similar purpose in international transactions, it is important to note the differences between the two identification codes and use the appropriate code for each type of transaction.