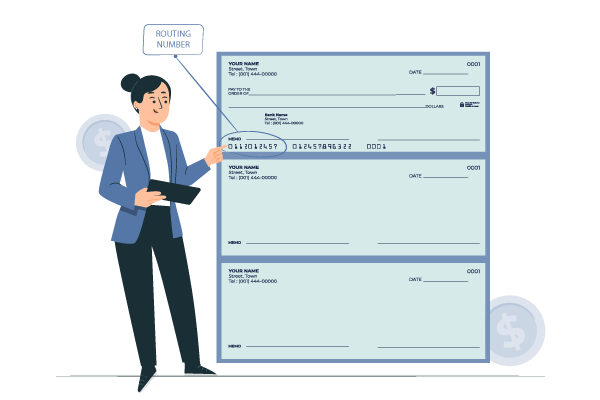

Check Routing Number is a nine-digit number assigned to banks in the United States. It is also known as an ABA number, Routing Number, or Routing Transit Number (RTN). The bank ABA number on check is your bank’s electronic identifier, distinguishing from all the other banks. The Check routing number location is at the bottom left corner of your check. Using the check printing program from Zil Money, you can easily customize your business check routing number, account number, and check number and print them on blank check stock using any standard printer. Since images now handle checks, you no longer need an expensive MICR printer.

Click Here To See The Interactive Demo

Where Is the Routing Number on a Check?

The account and check routing number location is always at the bottom-left corner of a check, making it easy to find. The nine-digit route number tells the bank where your account is held and which bank it is at. Most of the time, your account and check numbers come after the ABA transit numbers. Zil Money is a cloud-based tool that lets you print blank checks with bank business check routing number and account information. Banks accept these checks because they use OCR technology to read the information on the checks. It’s important to use the correct ABA number for your financial transactions to proceed smoothly. Checking this information twice will help you avoid any problems.

What Does the Routing Number Do?

The ABA transit number’s main job is to ensure transfers go smoothly and safely. ABA numbers ensure that financial transactions are accurate and safe by linking the banks to the right accounts. In the U.S. banking system, it is required for various types of traditional and online transactions. Zil Money is a platform for printing checks from the cloud. You can use a regular printer and blank check stock to make checks.

The Importance of Numbers in Check

Three numbers are arranged from the left as routing, account, and check numbers at the bottom of a check. The ABA number identifies which bank holds the checking account. Account number identifying your account within a bank. The check number is used for record-keeping and tracking, ensuring each check is unique. Zil Money allows you to customize and print checks instantly from anywhere, at anytime, using any printer, blank stock paper, or white paper.

Account Number on the check

The account number is a 12-digit number usually located at the bottom of the check, to the right of the ABA transit number. The account number identifies individual savings or checking accounts. This number is used to specify which account will be debited or credited during a financial transaction. You can print checks from your home or office using a regular printer and blank check stock.

Understanding the Relationships of Account Numbers and ABA Numbers

Different sets of numbers distinguish the routing check number and account number. The ABA number simply identifies your bank where the account is held, and the account number determines where the funds should be deposited or withdrawn. You will need both account and ABA transit numbers to execute any financial transactions. Both the account number and ABA transit numbers play a role in facilitating accurate and secure financial transactions.