Trusted by Businesses Nationwide

$100B+

Transaction volume

1M+

Active businesses

99.9%

Uptime SLA

67%

Average expense reduction

Manual payment processing is broken.

Every month, the same tedious process. Hours wasted on what should take minutes. Here’s how we fix it.

SOLVED

Manual Data Entry Hell

Typing hundreds of payment details individually, constantly switching between spreadsheets and banking portals.

SOLVED

Error Prone Process

Typos in payment amounts, wrong account numbers, missed payments – manual processing breeds costly mistakes.

SOLVED

Time Drain

What should take 10 minutes stretches into 4+ hours of tedious, error-prone manual processing.

SOLVED

Fee Multiplication

$3-5 transaction fee per payment multiplied by hundreds of payments equals thousands wasted monthly.

SOLVED

Manual Data Entry Hell

Typing hundreds of payment details individually, constantly switching between spreadsheets and banking portals.

.…

SOLVED

Time Drain

What should take 10 minutes stretches into 4+ hours of tedious, error-prone manual processing.

....

SOLVED

Error Prone Process

Typos in payment amounts, wrong account numbers, missed payments – manual processing breeds costly mistakes.

....

SOLVED

Fee Multiplication

$3-5 transaction fee per payment multiplied by hundreds of payments equals thousands wasted monthly.

….

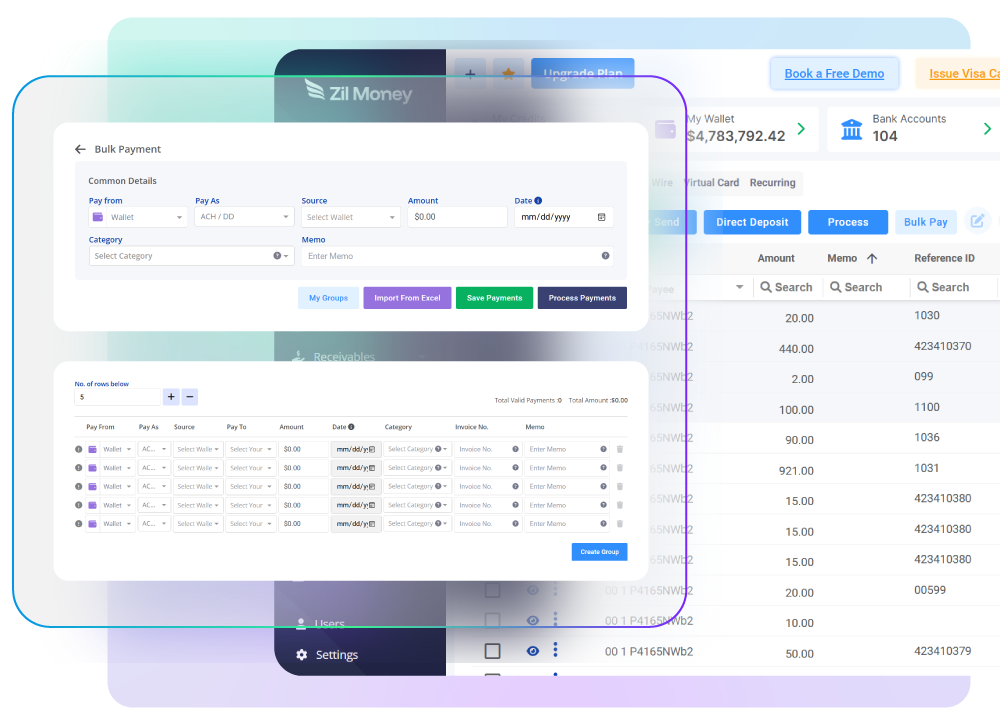

How bulk payments should work.

Upload once, process instantly, save thousands. The way payment processing was always meant to be.

Upload & Process

Simply upload your CSV file and watch as hundreds of payments get processed automatically in minutes, not hours.

10x faster processing

Zero Transaction Fees

Pay zero transaction fees on eligible payments when using your Zil Money wallet. Save thousands monthly on bulk processing fees.

Save $2,000+ monthly

Perfect Accuracy

Built-in validation checks eliminate typos and errors. Every payment processed exactly as intended, every time.

99.9% accuracy rate

Instant Processing

Upload your file and payments begin processing immediately. No waiting, no delays, no manual intervention needed.

Process in under 5 minutes

Real-Time Tracking

Monitor every payment’s status in real-time. Complete visibility into what’s processed, pending, or requires attention.

Complete transparency

Smart Automation

Set up recurring bulk payments that process automatically. Perfect for payroll, vendor payments, and regular disbursements.

Set once, process forever

Upload & Process

Simply upload your CSV file and watch as hundreds of payments get processed automatically in minutes, not hours.

10x faster processing

.…..

Zero Transaction Fees

Pay zero transaction fees on eligible payments when using your Zil Money wallet. Save thousands monthly on bulk processing fees.

Save $2,000+ monthly

..….

Perfect Accuracy

Built-in validation checks eliminate typos and errors. Every payment processed exactly as intended, every time.

99.9% accuracy rate

...…

Instant Processing

Upload your file and payments begin processing immediately. No waiting, no delays, no manual intervention needed.

Process in under 5 minutes

…...

Real-Time Tracking

Monitor every payment’s status in real-time. Complete visibility into what’s processed, pending, or requires attention.

Complete transparency

…...

Smart Automation

Set up recurring bulk payments that process automatically. Perfect for payroll, vendor payments, and regular disbursements.

Set once, process forever

…...

Simple by design.

From CSV to completed payments in four effortless steps. No complicated setup, no learning curve.

Create your account

Quick setup gets you ready to process bulk payments in minutes. Simple verification, no complex onboarding.

Upload your file

Drag and drop your CSV with payment details. Our system validates everything and flags any issues instantly.

Review and approve

Quick preview of all payments with total amounts. Make any adjustments before processing with one click.

Track completion

Watch payments process in real-time with complete status updates. Get notifications when everything’s complete.

Create your account

Quick setup gets you ready to process bulk payments in minutes. Simple verification, no complex onboarding.

.…

Upload your file

Drag and drop your CSV with payment details. Our system validates everything and flags any issues instantly.

....

Review and approve

Quick preview of all payments with total amounts. Make any adjustments before processing with one click.

.…

Track completion

Watch payments process in real-time with complete status updates. Get notifications when everything’s complete.

….

Perfect for every bulk payment need.

From payroll to vendor payments, if you’re paying multiple recipients, we make it effortless.

Payroll Processing

Pay all employees instantly with direct deposit. Handle different amounts, accounts, and payment schedules seamlessly.

Vendor Payments

Process hundreds of supplier payments simultaneously. Keep your supply chain happy with on-time, accurate payments.

Contractor Payouts

Pay freelancers, consultants, and independent contractors efficiently. Handle variable amounts and payment terms easily.

Commission & Bonuses

Distribute performance bonuses, sales commissions, and incentive payments to large teams quickly and accurately.

Loan Disbursements

Financial institutions can process multiple loan disbursements simultaneously with complete accuracy and tracking.

Refund Processing

Handle customer refunds in bulk efficiently. Process hundreds of refunds with complete audit trails and tracking.

Payroll Processing

Pay all employees instantly with direct deposit. Handle different amounts, accounts, and payment schedules seamlessly.

.…..

Vendor Payments

Process hundreds of supplier payments simultaneously. Keep your supply chain happy with on-time, accurate payments.

..….

Contractor Payouts

Pay freelancers, consultants, and independent contractors efficiently. Handle variable amounts and payment terms easily.

...…

Commission & Bonuses

Distribute performance bonuses, sales commissions, and incentive payments to large teams quickly and accurately.

…...

Loan Disbursements

Financial institutions can process multiple loan disbursements simultaneously with complete accuracy and tracking.

…...

Refund Processing

Handle customer refunds in bulk efficiently. Process hundreds of refunds with complete audit trails and tracking.

…...

Enterprise-grade security.

Your bulk payment data is protected with the highest security standards in the financial industry.

Data Encryption

All payment data encrypted with 256-bit encryption during upload, processing, and storage. Your data stays completely secure.

SOC 2 Compliance

Independently audited and certified for security controls, ensuring your bulk payment data meets enterprise standards.

Banking Partners

Banking services provided through partnerships with FDIC member banks, ensuring your funds are always protected.

Access Controls

Multi-factor authentication and role-based permissions ensure only authorized users can process bulk payments.

Data Encryption

All payment data encrypted with 256-bit encryption during upload, processing, and storage. Your data stays completely secure.

.…

SOC 2 Compliance

Independently audited and certified for security controls, ensuring your bulk payment data meets enterprise standards.

....

Banking Partners

Banking services provided through partnerships with FDIC member banks, ensuring your funds are always protected.

.…

Access Controls

Multi-factor authentication and role-based permissions ensure only authorized users can process bulk payments.

….

Life-changing simplicity.

Join thousands who’ve eliminated bill payment stress from their lives forever.

Cory Edwards, Owner Edwards Holdings Realty

“The most helpful part is that Zil Money can be used by everyone. It’s very easy to navigate. THE USER INTERFACE is very easy to learn.

It solves the problem of having various accounting software separately and unable to integrate. It allows seamless organization.“

Everything you need to know.

Common questions about bulk payment processing with Zil Money.

Zero transaction fees on eligible payments apply when you use your Zil Money wallet balance to fund bulk payments. Simply load your wallet from your bank account, then process all payments with no per-transaction fees.

We accept CSV files with columns for recipient name, account number, routing number, payment amount, and optional reference notes. We provide templates to ensure your file is formatted correctly.

You can process up to 10,000 payments in a single batch upload. For larger volumes, simply split into multiple batches or contact our enterprise team for custom solutions.

Processing begins immediately after approval. ACH payments typically complete within 1-2 business days, while same-day processing is available for an additional fee during business hours.

Yes! You can schedule bulk payments up to 30 days in advance. Perfect for payroll, recurring vendor payments, or any scheduled bulk disbursements.

Failed payments are immediately flagged with detailed reason codes. You can quickly fix issues and reprocess individual payments without affecting the entire batch.

Comprehensive reporting includes batch summaries, individual payment status, success rates, and detailed audit trails. Export reports for accounting and compliance needs.