Check fraud is a well-known issue that never goes away. Since fraudsters’ techniques are always evolving along with technology, firms must implement advanced security measures to protect financial assets. Positive Pay banking is one such useful instrument in the battle against check fraud.

Benefits of Positive Pay

Check Verification

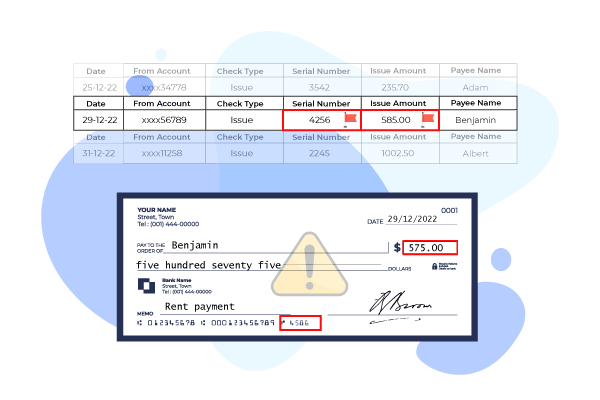

Through a cross-reference with the business’s provided information, Positive Pay confirms the legitimacy of every check. This lowers the possibility of fraudulent transactions by guaranteeing that only authorized checks are handled.

Exception Reporting

Any discrepancies between the issued check information and the presented check trigger an exception report. This allows businesses to thoroughly review and either approve or reject flagged items, effectively preventing unauthorized transactions.

Customization

Positive Pay solutions are adaptable to each business’s unique requirements. To improve the accuracy of fraud detection, businesses can specify characteristics like the amount of the check, the payee’s identity, and other information.

Real-time Monitoring

Instant notifications for possible fraudulent activity are sent out by the system, which runs in real-time. This quick response time is essential for stopping losses and reducing the negative effects of fraud on the financial stability of a company.

Cost-effective

Although no system that can ensure complete safety, Positive Pay is an economical way to reduce the likelihood of check fraud. The system’s implementation and maintenance expenses are much outweighed by the potential savings in terms of avoided losses.

Transforming Positive Pay for the Modern Era

Zil Money is transforming how companies use Positive Pay to strengthen security protocols. The platform offers customizable features, allowing businesses to modify Positive Pay to one’s specific needs. This adaptability ensures that security measures align with the unique financial landscape of each business. The platform integrates with various accounting systems, enhancing the efficiency of Positive Pay by automating the submission of check data. The platform’s real-time check monitoring feature, allows businesses to vigilantly watch for potential fraud attempts. Immediate notifications are triggered in the presence of any irregularities, enabling quick action to be taken.

Businesses can greatly improve security protocols and preserve the integrity of the financial operations in the face of changing threats by utilizing the features and advantages of Positive Pay. Businesses hoping to prosper in a safe financial environment will need to be aware of and implement strong security measures like Positive Pay as technology develops.