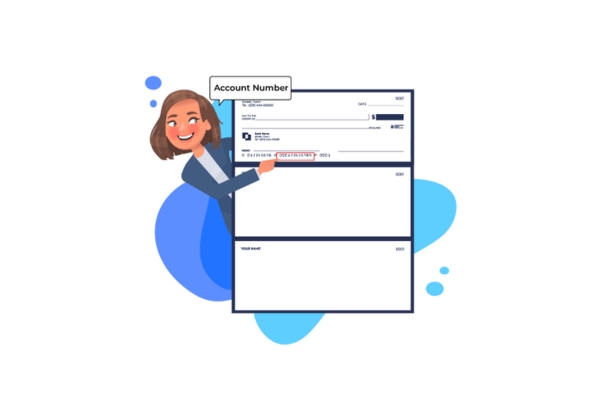

In an era where digital interactions dominate, understanding and implementing effective measures to verify and validate check account number have become critical safeguards for entrepreneurs. The financial stability of any business depends on the authenticity and validity of transactions. Account verification plays a significant role in safeguarding transactions and fortifying the foundations of financial integrity.

The Growing Importance of Account Verification

Combatting Identity Theft and Fraud

Identity theft and fraud pose significant threats to businesses, leading to financial losses and damage to reputation. Account verification services act as a powerful deterrent against these risks by implementing multi-layered identity verification processes. This helps businesses ensure that they are dealing with legitimate customers.

Reducing Manual Workload

Automation is key to efficiency, and account verification services automate the verification process, reducing the need for manual intervention. This not only speeds up the onboarding process but also minimizes the risk of human error associated with manual verification.

Building Trust with Customers

Account verification services help establish and preserve confidence by reassuring clients that data is safe and that the company values user’s privacy. This trust is especially vital in online transactions where customers may be hesitant to share personal information without adequate assurances.

Account verification services

Zil Money’s account verification services stand as an important tool for American entrepreneurs seeking to strengthen business operations. By prioritizing security, compliance, and customer trust, the platform allows entrepreneurs to navigate the digital landscape with confidence. The platform employs cutting-edge technologies to combat identity theft and fraud, ensuring that American entrepreneurs can conduct business transactions with confidence. The platform’s account verification services are designed to help businesses meet stringent regulatory standards, such as KYC and AML laws. The platform prevents unauthorized access through advanced authentication methods like two-factor authentication (2FA) and biometric verification. The platform automates the verification process. This not only accelerates onboarding but also minimizes the risk of human error associated with manual verification, allowing entrepreneurs to focus on strategic aspects of business.

Account verification services play a pivotal role in the success and security of modern businesses. American entrepreneurs can use these services to fortify operations, comply with regulations, and build trust with customers. As technology continues to advance, staying ahead of potential risks and implementing robust account verification measures is not just a business strategy but a necessity in safeguarding the future of enterprises in the digital age.