In today’s fast-paced and digital-driven world, financial security is a critical concern for businesses of all sizes. With the increasing prevalence of fraudulent activities, safeguarding transactions and preventing unauthorized payments has become a top priority. One powerful tool that aids in achieving this is positive pay, offered by Zil Money, a mechanism that allows businesses to inform their banks about issued checks in advance. With positive pay in banking, banks can cross-verify the presented checks against the ones reported by the company, ensuring that only legitimate payments are processed.

Understanding Positive Pay

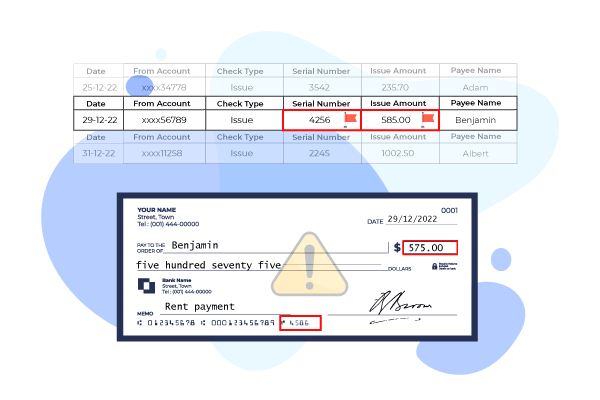

Positive pay in banking is an automated fraud detection system utilized by banks. It’s a process where you inform your bank about the checks you’ve issued in advance. The bank then cross-references the checks presented for payment against your submitted list, clearing only those checks that match a check number, account number, and dollar amount. This effectively prevents unauthorized payments and aids in cash management.

ZilMoney’s Approach to Positive Pay

ZilMoney.com has incorporated positive pay in banking into its system, delivering a streamlined and automated version of this valuable service. Once you issue checks, ZilMoney.com automatically transmits the details to your bank. This eliminates the need for manual communication with the bank, thus minimizing the chance of errors and oversights. Additionally, ZilMoney.com promptly informs the bank if a check is canceled, ensuring real-time updates and enhanced security.

Benefits of Using Zil Money for Positive Pay

Leveraging ZilMoney.com’s positive pay in banking service offers several distinct advantages. First and foremost, it provides a significant layer of protection against check fraud, a rampant issue in today’s digital age. This platform effectively safeguards your company’s finances by cross-verifying the details of each presented check.

Secondly, the automation provided by ZilMoney.com saves time and ensures accuracy. Manual data entry can be prone to human error; automated transmission of check details removes this risk.

Thirdly, the platform’s positive pay in banking system is flexible and adaptable. Whether dealing with a single bank or managing multiple accounts across different institutions, the platform can efficiently handle the communication and verification process.

Moreover, the real-time communication between ZilMoney.com and your bank provides peace of mind. With instant notifications about canceled checks, you can be confident that your bank is always up-to-date with your transactions.

Conclusion

Positive pay in banking has emerged as an indispensable tool, offering businesses a proactive approach to combating fraudulent activities and ensuring the security of their financial transactions. ZilMoney.com’s positive pay in banking service takes this functionality to the next level, providing businesses with a seamless and efficient solution to protect their check payments. By leveraging the platform, businesses can easily transmit their issued check details to the bank, eliminating manual communication and minimizing the risk of errors. In addition, the real-time notifications and updates provided by the platform further enhance the security of transactions, ensuring that businesses are always aware of canceled checks and unauthorized payment attempts.