Trusted by Businesses Nationwide

$100B+

Transaction volume

1M+

Active businesses

99.9%

Uptime SLA

67%

Average expense reduction

See Your Earning Potential

Calculate exactly how much you could earn in rewards while improving your cash flow

Why Smart Businesses Choose Credit Card Payments

Transform necessary expenses into strategic financial advantages

Extend Cash Flow

Pay bills today, settle with your card in 30-45 days. Keep working capital available for growth opportunities and unexpected expenses.

Earn on Every Payment

Convert every business expense into credit card rewards. Hit spending thresholds faster and maximize points, miles, or cashback.

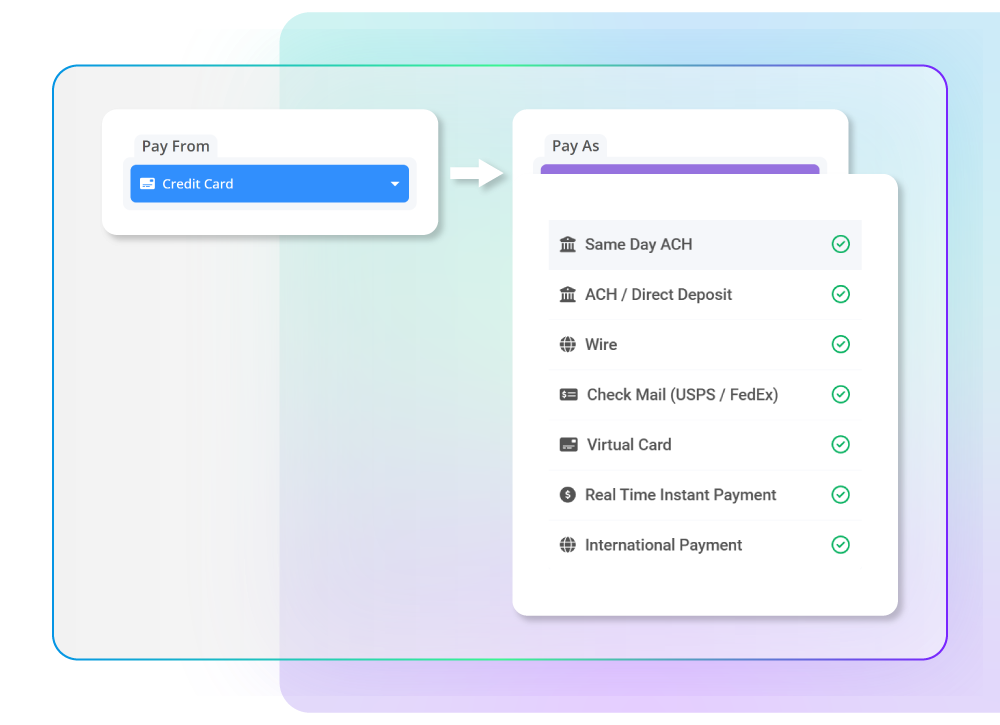

Pay Anyone, Anywhere

Vendors receive payment exactly how they prefer—check, ACH, or wire. No changes needed to their processes or systems.

Build Business Credit

Regular usage and timely payments improve your business credit profile, unlocking better financing terms and partnerships.

Extend Cash Flow

Pay bills today, settle with your card in 30-45 days. Keep working capital available for growth opportunities and unexpected expenses.

.…

Earn on Every Payment

Convert every business expense into credit card rewards. Hit spending thresholds faster and maximize points, miles, or cashback.

....

Pay Anyone, Anywhere

Vendors receive payment exactly how they prefer—check, ACH, or wire. No changes needed to their processes or systems.

....

Build Business Credit

Regular usage and timely payments improve your business credit profile, unlocking better financing terms and partnerships.

….

Three simple steps to transform your business payments

Connect Your Card

Securely link any business credit card with bank-level encryption. Setup takes under 2 minutes.

...

Enter Payment Details

Upload invoices or enter vendor information. Choose delivery method and timing preferences.

...

Earn & Track

Your card is charged, vendor gets paid their way, you earn rewards. Monitor everything in real-time.

...

Why Zil Money vs Traditional Methods

See how credit card payments transform your business operations

Payment Method Comparison

Traditional Banking

Immediate cash outflow

No rewards earned

Wire transfer fees

Limited payment options

Manual processes

Zil Money Credit Card Payment

30-45 day payment terms

Earn points/cashback

Transparent 2.9% fee

Pay anyone, any method

Automated workflows

Other Fintechs

Some payment flexibility

Limited rewards options

Complex fee structures

Vendor limitations

Basic integrations

Every Business Type Benefits

From start-ups to enterprises, see how credit card payments drive success

Construction Companies

Pay subcontractors and suppliers while maintaining cash flow for equipment and materials. Earn rewards on large purchases.

Tech Startups

Extend runway by 30+ days, pay contractors globally, and earn rewards on software subscriptions and cloud services.

Healthcare Practices

Pay medical suppliers, equipment vendors, and service providers while improving cash flow for patient care investments.

Retail Businesses

Manage seasonal cash flow, pay inventory suppliers, and earn rewards on marketing and operational expenses.

Professional Services

Pay freelancers, software subscriptions, and office expenses while maximizing rewards on business travel and equipment.

Manufacturing

Manage complex supply chains, pay global suppliers, and maintain cash flow for raw materials and equipment maintenance.

Construction Companies

Pay subcontractors and suppliers while maintaining cash flow for equipment and materials. Earn rewards on large purchases.

.…..

Tech Startups

Extend runway by 30+ days, pay contractors globally, and earn rewards on software subscriptions and cloud services.

..….

Healthcare Practices

Pay medical suppliers, equipment vendors, and service providers while improving cash flow for patient care investments.

...…

Retail Businesses

Manage seasonal cash flow, pay inventory suppliers, and earn rewards on marketing and operational expenses.

…...

Professional Services

Pay freelancers, software subscriptions, and office expenses while maximizing rewards on business travel and equipment.

…...

Manufacturing

Manage complex supply chains, pay global suppliers, and maintain cash flow for raw materials and equipment maintenance.

…...

Beyond Payments—Business Growth

Discover the competitive advantages of strategic payment management

Tax Optimization

Earn business deductions on expenses while maximizing credit card rewards—double the financial benefit for your business.

Emergency Preparedness

Handle unexpected costs instantly without loan approvals or cash transfers when time-sensitive opportunities arise.

Scale Without Limits

Pay large invoices without depleting cash reserves. Use credit capacity to accelerate business growth and expansion.

Financial Protection

Credit card dispute protection and fraud monitoring safeguard your business transactions and vendor relationships.

Tax Optimization

Earn business deductions on expenses while maximizing credit card rewards—double the financial benefit for your business.

.…

Emergency Preparedness

Handle unexpected costs instantly without loan approvals or cash transfers when time-sensitive opportunities arise.

....

Scale Without Limits

Pay large invoices without depleting cash reserves. Use credit capacity to accelerate business growth and expansion.

....

Financial Protection

Credit card dispute protection and fraud monitoring safeguard your business transactions and vendor relationships.

….

Works With Your Existing Tools

Connect with 22,000+ platforms and streamline your entire payment workflow

Simple, Straightforward Pricing

No hidden fees, no monthly charges, no surprises

Questions & Answers

Everything you need to know about credit card payments

Bank-Level Security

No Setup Fees

2-Minute Setup

24/7 Support

*ZilMoney is a financial technology company, not a bank. Banking services provided through partnerships with FDIC member banks.