Cybercriminals want access to your company, but there are safeguards in place. Use Positive Pay tools to stop account fraud from every angle and take full control of your company’s accounts. The advanced technology that we have today encourages more financial fraud. This is inevitable, given human nature. We won’t be able to eliminate fraud, but we can minimize them to a certain extent. Using positive pay and printing your check can prevent check fraud, and Zil Money provides you with both these features on the same platform. Keep reading to learn more.

What Is Positive Pay?

An automated cash-management service, positive pay, is used by banks to reduce the risk of check fraud. Financial institutions use the positive pay system to verify the validity of company checks presented for payment. Any check deemed suspicious is returned to the issuer for examination. This system protects a business in the event of fraud, losses, or other liabilities to the bank and functions as a form of insurance.

How Positive Pay Work?

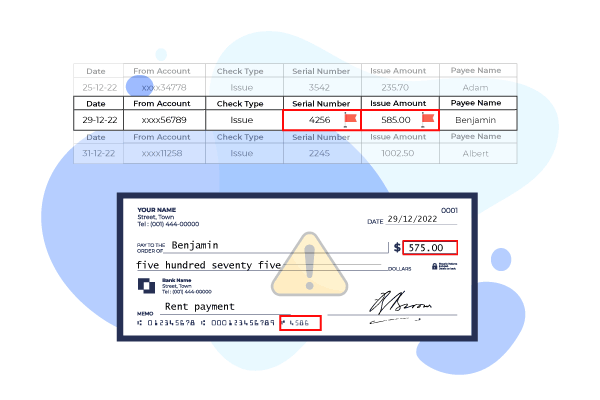

The service compares each check’s check number, dollar amount, and account number to a company list to prevent forgeries. Some checklists include the payee. These must match for the bank to clear the check. Identity thieves and fraudsters can create counterfeit checks that may be honored if security checks are not in place.

When the information does not match the check, the bank sends an exception report to the customer and withholds payment until the company decides whether to accept or reject the check. The bank can flag the check, notify a company representative, and request clearance.

Furthermore, if the company discovers only a minor error or problem, it can advise the bank to clear the check. If the company fails to send a list to the bank, all checks presented that should have been included may be rejected, resulting in financial difficulties.

Reverse Positive Pay

The reverse positive-pay system is a variation of the positive-pay concept. This system requires the check issuer to keep an eye on their checks, and it is up to the check issuer to tell the bank when a check has been turned down. The bank notifies the business daily of all presented checks and clears checks that the business has approved.

The bank will cash the check if the company fails to respond within a reasonable amount of time. This method is less reliable and effective than positive pay, but costs less.

Prevent Check Fraud with Positive Pay and Blank Check Stock

Positive pay is used for every check presented for payment, making this the bank’s best check fraud defense. Positive Pay checks your company’s checks against those presented for payment on your account. Banks report inconsistencies to the issuer while checking.

Positive Pay, when combined with printing your own check on check stock paper, can significantly reduce your company’s risk of fraudulent activity and payment fraud.

Positive Pay allows your company to stay one step ahead of criminals while protecting its cash flow. Implementing strategies today to ensure future protection leaves less room for error. Positive pay cannot eliminate fraud activities but can significantly reduce risk and keep your finances safe.

Positive Pay in Zil Money

Zil Money now has an automated service called Positive Pay that you can use. Zil Money will send the list of checks that your company has issued to the bank using one of the following methods: API, FTP, or an excel sheet upload. In addition, when you cancel the check, Zil Money will notify the bank immediately and void any already written checks. You won’t have to manually inform the banks when you issue or cancel checks because they will be notified automatically. While Zil Money takes care of everything, you’ll be able to relax and enjoy life to the fullest.

What is Exception Item?

When a check is presented to the bank and does not match the list of checks that have been issued, the check is referred to as an “exception item.” A fax or an image of the check will be sent to the customer if there is an exceptional item.

Positive pay allows a company to stay one step ahead of criminals while protecting its cash flow. Implementing strategies today to ensure future protection leaves less room for error. Most commercial banks offer it as a way to protect businesses of all sizes from fraud, and it should be seriously considered. With Zil Money, we will send the list of checks your company has issued to the bank, and if you cancel or void a check, we will immediately pass this information to your bank.