You’ve probably been asked to pay using eChecks, and you’ve probably been overwhelmed while hearing this word. There’s no need to panic; this is just what we call a digital check or electronic check, it’s a future check. Keep reading to know more about eCheck payment, and how it’s useful for an individual or business. Zil Money provides a quick and easy way to make an eCheck payment with many advantages.

What Is An eCheck?

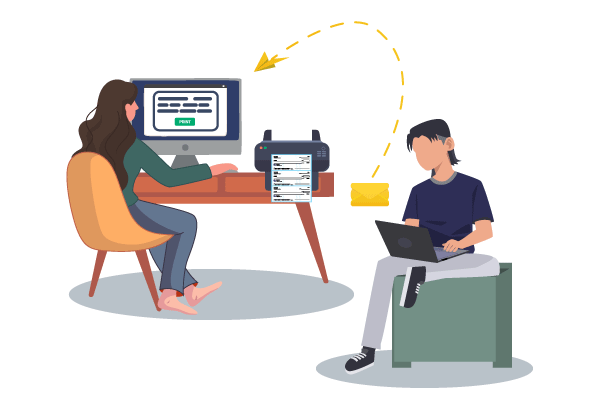

An electronic check, often known as an “eCheck,” it’s also known as a digital check, an internet check, or a direct debit transfer. It’s a kind of payment made over the internet or another data network that serves the same purpose as a traditional paper check. Since the check is an electronic form, it can be processed in fewer steps. eCheck is a type of electronic funds transfer that uses the ACH network to process customer payments to the payee’s account, or you could send this digital check via email so the recipient can print it and cash it.

How Does eCheck Work?

Processing checks electronically is much quicker than processing checks on paper. Technology makes it possible to do the process electronically, which saves time and cuts down on paper waste. A person doesn’t have to write out a check by hand and mail it to the company they need to pay. Instead, they can do it online.

Here are the steps for processing an electronic check:

- Request authorization.

- Payment set-up.

- Finalize and submit.

- Deposit funds.

The Benefits Of Electronic Checks

In general, there are a lot fewer costs involved with sending an electronic check than with having to send a paper check. In addition to saving on the expense of printing and mailing paper checks, electronic checks also eliminate the need for additional postage when sending money to parties who are physically located in another location. Estimates show that issuing a traditional check could cost as much as $1 while issuing an electronic check costs closer to $0.10. Also, there are several levels of authentication to make sure that funds are sent the right way.

There are several benefits of using electronic checks as a payment method:

- Convenience: eChecks can be processed quickly and easily online, reducing the need for paper checks and mailing physical payments.

- Security: eChecks are processed through the Automated Clearing House (ACH) network, which is a secure, electronic system for transferring funds. This helps reduce the risk of fraud and ensures that payments are made to the correct recipient.

- Speed: eChecks are processed much faster than paper checks, as they are transferred electronically and there is no need for physical delivery.

- Cost-effective: eChecks are less expensive than paper checks as they do not require the cost of printing, mailing, and handling.

- Record keeping: eChecks provide an electronic record of the transaction which can be easily accessed and stored.

- Accessibility: eChecks can be used by businesses and individuals who do not have credit cards or online payment facilities.

- Reliability: eChecks are processed through the ACH network which is a reliable payment system that can handle a large volume of transactions.

- Automation: eChecks can be easily integrated with accounting software, which allows for automated, recurring payments and simplifies bookkeeping.

Can I Use eChecks For Recurring Payments?

eChecks are actually one of the most common ways to set up recurring payments. You might have also heard the terms “recurring ACH payment” or “direct debit,” which are the same as “recurring eCheck payment.”

For instance, property managers often ask renters to fill out a form for a recurring eCheck rent payment. This lets them take the rent out of their tenant’s checking account automatically on a certain day each month.

How Long Does It Take For An eCheck To Clear?

The way each provider clears eChecks is a little different, so the time it takes to process an eCheck also varies. Most of the time, funds are inspected within 24 to 48 hours after a transaction is started. If the payer has the money in their checking account, the transaction is usually cleared, and the money is sent to the payee’s account within three to five business days.

How To Cancel An eCheck?

If you own a business, you may be required to cancel an eCheck for one of your customers. How you do this will very much depend on the payment system you’re using and the transaction stage.

If the payment has already been taken from your account, you can’t cancel the electronic check. Instead, you’ll have to set up a refund. If the payment hasn’t been made yet, talk to your payment processor about what to do next.

When it comes to electronic check transfers, emails and text messages are possible, thanks to Zil Money. You can also use the information on the check to convert a received paper check into an electronic transfer. Use our platform to get it printed on white paper or check paper. eCheck payment is the best alternative to a physical check that has the same functionality as a paper check and can even be sent as an ACH transfer or via email.