Non-profit groups are crucial in tackling community problems, yet handling their money can frequently be a major hurdle. The traditional way of writing checks is slow, costly, and inexpensive. The cloud-based platform transforms this process with customizable check templates for printing that make transactions easier. By allowing NGOs to design and print checks as needed, the software improves operational efficiency and lowers printing expenses.

Click Here To See Interactive Demo⬇

The Significance of Check Templates

- Pre-designed layout greatly reduces the chances of mistakes, such as improper formatting or missing details.

- Many templates can be easily altered to suit specific branding requirements.

- They provide a uniform appearance for all checks from an organization.

- Templates simplify the check-writing process by allowing users to swiftly enter the relevant information.

Elements of a Check

- The date on which the check is issued.

- The name of individual or organization receiving the check.

- Amount of check in word and numbers.

- Memo line for indicating the reason for writing the check.

- Your personal information like name, address.

- Bank details

- The payer has to sign the check to indicate permission for funds to be withdrawn from the account.

- The check number usually located in the upper and lower right corners of a check is used for tracking purpose.

- Routing number to identify the financial institution involved in the transaction.

- Account number to locate the account from which money will be taken out.

How the Cloud-Based Platform’s Check Templates Simplify Transactions for NGO’s?

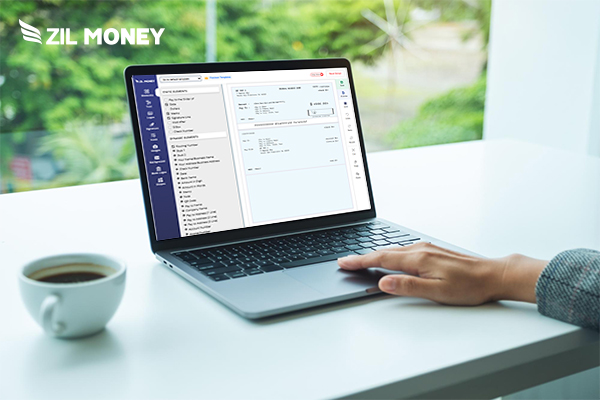

A check template is a pre-designed document that helps non-governmental organizations simplify the process of creating checks. Zil Money lets you make customized checks easily. This is beneficial for NGOs that need to maintain professional standards while staying within their budget.

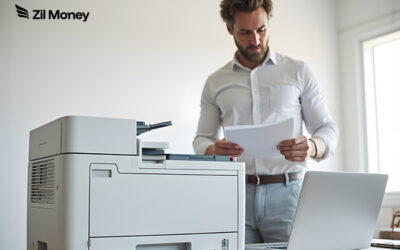

Zil Money enables to print checks on demand, minimizing the risk of running out during key fundraising events or project payments. NGO’s can create checks as required, whether for receiving grants or paying employees, assuring smooth functioning.

One of the significant advantages of using the cloud-based platform is the ability to print checks on blank stock paper.

- Using blank check paper reduces the check printing cost by 80%.

- It also eliminates the need for ordering costly pre-printed checks.

- You can easily purchase blank check stock from nearby office supply stores or online retailers.

- With blank check stock users can add relevant details at the time of printing and make changes as required. This significantly reduces check wastage.

Zil Money provides various check templates that you can customize to match your NGO’s brand. With just a few simple steps, you can select from many appealing check designs. The drag-and-drop design feature from the software allows you easily add

- Organization’s logo and name.

- Unique font style and background images

- Add your digital signature.

- Input important information like your account and routing numbers.

Selecting the Best Way to Send Checks

Once the personalized checks are made, Zil Money provides the choice to dispatch them either as eChecks or through the traditional mail.

eChecks: Electronic checks are digital counterparts of traditional paper checks. Using an eCheck funds are transferred from payer’s checking account, moved through the ACH network and put into the recipient’s checking account.

The platform lets you send eChecks as a one-time printable PDF to your payee through email or SMS. They can print these using a standard printer on blank check paper.

Checks by Mail: You can mail checks at an affordable rate through the cloud-based platform, covering postage and paper expenses. You can relax knowing that the platform takes care of printing, labeling, enveloping, and mailing your checks on the same business day via USPS or FedEx.

The Importance of Implementing Positive Pay for Check Security

Zil Money’s positive pay feature provides robust protection against check fraud. This feature lets you notify your financial institution in advance about checks you’ve written before they’re cashed. This ensures that banks will only accept checks that have been reported to them. As a result, you won’t have to worry about losing money due to fraudulent activity on your account.

Banks typically use this service to keep their funds safe and prevent unauthorized payments. When a check is ready to be cashed, the bank compares the check number, account number, and the amount written on the check to the one you’ve issued. Checks that don’t match are sent back to the person who wrote them.

Utilizing the modern digital tools simplifies the process of creating checks. The check printing software is an essential element in the financial toolkit to effortlessly make checks. The software allows you to customize and print checks instantly from anywhere. As we keep adopting digital solutions in our everyday activities, the option of printing checks online becomes a smart option for handling finances with ease and efficiency.