Automatic

Verification

Real-Time

Protection

Every Check

Secured

Complete

Control

*Positive Pay helps prevent check fraud by matching presented checks against your authorized check register. Requires accurate and timely submission of check details. Some banks charge separate fees for Positive Pay services. Terms apply. Visit zilmoney.com terms and conditions.

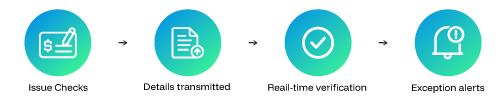

Automatic protection in three steps

You Issue Checks

When you create checks through Zil Money, check details (number, amount, payee, date) automatically transmit to your bank’s Positive Pay system.

← ••• →

Bank Receives Check

Someone presents your check for payment. Bank compares the presented check against your authorized register in real-time.

← ••• →

Verify or Block

Match found: Check clears normally

Mismatch detected: Check blocked, you’re notified to approve or reject

Unauthorized check: Rejected automatically

← ••• →

The Protection: If any detail doesn’t match your register, the check won’t clear without your approval.

Five verification points on every check

Check Number

Protected Against: Stolen blank checks, unauthorized check numbers

← ••••• →

Payment Amount

Protected Against: Altered amounts, increased values

← ••••• →

Payee Name

Protected Against: Changed payees, check washing

← ••••• →

Issue Date

Protected Against: Backdated or altered dates

← ••••• →

Complete Match

Protected Against: Any discrepancy triggers review before payment

← ••••• →

Result: Every detail must match your authorized register for check to clear.

Four fraud methods Positive Pay stops

Stolen Checks

Blank checks stolen from your office or mail. Fraudsters fill them out and attempt to cash them. Positive Pay Blocks: Check numbers not in your register won’t clear.

← •••• →

Altered Checks

Legitimate checks intercepted, amounts increased, or payee names changed. Positive Pay Blocks: Mismatched amounts or payees trigger immediate review.

← •••• →

Counterfeit Checks

Fake checks created using your account information that look legitimate. Positive Pay Blocks: Unauthorized check numbers rejected automatically.

← •••• →

Check Washing

Chemicals remove ink from legitimate checks, new payee and amount written in.

← •••• →

Positive Pay Blocks: Changed payee names or amounts detected and blocked.

Integrated protection, not added work

Automatic Submission

Issue checks through Zil Money → Details automatically sent to bank → No manual file uploads or spreadsheets

← •••• →

Real-Time Verification

Every check presented is verified immediately against your register before clearing

← •••• →

Exception Handling

Mismatched checks trigger notification → You review and decide → Approve legitimate or reject fraudulent

← •••• →

Complete Audit Trail

Track every check from creation through clearing, see what was blocked and why

← •••• →

The Difference: Positive Pay built into your workflow, running automatically in the background.

Essential for businesses issuing checks.

High Check Volume

Issue multiple checks monthly? More checks means more fraud exposure. Positive Pay scales with your volume.

Growing Companies

Rapid growth often means less financial oversight. Positive Pay provides security even when you’re focused on scaling.

Multiple Check Signers

More people with check authority increases risk. Positive Pay ensures only authorized checks clear.

Any Check User

If you issue checks, you’re a target. One prevented fraud can pay for years of protection.

Enable protection, run automatically

Initial Setup

Enable Positive Pay in your Zil Money account

Coordinate with your bank's Positive Pay system

Configure notification preferences

Start issuing protected checks

*Typical setup time varies by bank coordination requirements

Ongoing Operation

👤 Your Work:

Review and decide on exceptions when notified (rare occurrence)

📅 Most Days:

Zero notifications, complete background protection running automatically

Works with major business banks

Supported Banks:

Most major business banks offer Positive Pay services, including Chase, Bank of America, Wells Fargo, U.S. Bank, PNC, Citibank, and hundreds of regional and community banks.

← ••• →

Bank Fees:

Some banks charge a separate monthly fee for Positive Pay services (typically varies by bank and account type). Check with your bank for specific pricing.

← ••• →

Verification:

Contact your bank to confirm Positive Pay availability and any associated fees before enabling.

← ••• →

← •••••• →

← •••••• →

← •••••• →

← •••••• →

← •••••• →

← •••••• →

Common questions

Fraud prevention service that automatically verifies every presented check against your authorized check register. Checks that don't match are blocked before clearing your account.

When you issue checks through Zil Money, details automatically send to your bank. When someone presents a check, the bank verifies check number, amount, payee, and date match your register. No match = check blocked for your review.

After initial setup, check details automatically transmit with every check you issue. No manual file uploads or daily tasks. You're notified only when exceptions occur (mismatched checks requiring your decision).

Bank blocks the check before money leaves your account. You receive notification of the mismatch. You review details and approve (if legitimate error) or reject (if fraudulent).

Most major business banks offer Positive Pay. Contact your bank to confirm availability and any fees they charge for the service.

Minor discrepancies trigger exception notification. You review the check, confirm it's legitimate despite the error, and approve payment. You maintain control over all exceptions.

Yes. Works with printed checks, mailed checks, and any check drawn on your business account. Protection applies regardless of how check is physically distributed.

Some banks charge a monthly fee for Positive Pay services (varies by bank). Zil Money includes automatic check detail transmission as part of your account. Check with your bank for their specific Positive Pay pricing.

Protect every check you issue.

Check fraud attempts are blocked automatically before money leaves your account. One prevented fraud incident typically exceeds years of protection costs.

What You Get

✓ Automatic check verification

✓ Real-time fraud blocking

✓ Exception notifications

✓ Complete audit trail

✓ Integrated protection

Setup

✓ Enable in your account

✓ Coordinate with your bank

✓ Automatic operation after setup

Positive Pay service helps prevent check fraud by matching presented checks against your authorized check register. Protection requires accurate and timely submission of check details to bank. Zil Money automatically transmits check details when checks are issued through the platform. Bank verification and timing vary by financial institution. Fraud prevention effectiveness depends on timely exception review and decision-making. Positive Pay helps reduce fraud risk but does not guarantee prevention of all fraud. Some banks charge separate fees for Positive Pay services—contact your bank for specific pricing. Setup timing varies based on bank coordination requirements. Business owner responsible for reviewing exception notifications and making approval or rejection decisions. Banking services provided through FDIC member banks. All services subject to approval, identity verification, and terms of service. Visit zilmoney.com terms and conditions for complete details.