eChecks is a type of future check; there were times when you were asked to pay using eChecks, and you must be consumed while hearing that term. It’s nothing to get afraid of, it’s called an electronic check or digital check. Keep reading to know more about eCheck, some of the questions regarding eCheck are explained below. Zil Money allows you to create eCheck and send them with many benefits instantly.

What is an eCheck ?

eCheck is a type of electronic funds transfer that uses the ACH network to process customer payments to the payee’s account. The technology for eCheck transactions was developed to cover traditional paper check processing and transaction, including bill payments, direct deposit, and other person-to-person transactions.

An eCheck is a digitized version of a paper check. It’s also known as an electronic check, digital check, internet check, or direct debit transfer. An eCheck is made using the Automated Clearing House (ACH) to move debits from a client’s checking account to a business bank account via a payments processor.

How does eCheck Work?

Processing checks electronically is far quicker than processing checks on paper. Technology enables the procedure to happen electronically, saving time and reducing paper waste. Instead of a consumer manually writing out a paper check and mailing it to the company they need to pay, the process can happen online.

Steps to process an electronic check are:

- Request authorization: Before completing the purchase, the client must give the firm their consent. This can be accomplished by a signed order form, recorded phone call, or online payment form.

- Payment set-up: Before completing the purchase, the client must give the firm their consent. This can be accomplished by a signed order form, recorded phone call, or online payment form.

- Finalize and submit: After entering all necessary data into the payment software, the company clicks “Save” or “Submit” to initiate an ACH transaction.

- Deposit funds: The customer receives a payment receipt from the online program, and the payment itself is transferred into the company’s bank account. The payment is automatically withheld from the customer’s bank account. Three to five business days following the start of the transaction, the money is usually placed into the merchant’s bank account.

Is EFT and ACH same as eCheck?

The fact that an eCheck is a sort of electronic funds transfer (EFT) that processes the payment using the Automated Clearing House (ACH) network is the easiest method to explain the similarities and distinctions between ACH, EFT, and eCheck.

When using an eCheck, the funds are electronically taken out of the payer’s account, forwarded to the payee’s financial institution over the ACH network, and then electronically deposited into the payee’s account. Everything is carried out electronically in a manner akin to processing paper checks.

How much time does an eCheck takes to get cleared?

eCheck processing times vary since the eCheck clearance procedure differs slightly between providers. Funds are typically verified 24 to 48 hours after the transaction is started. The transaction is normally cleared within three to five business days and the monies are sent to the payee’s account if the payer has the necessary cash in their checking account.

Will an eCheck bounce like a normal check?

In contrast to traditional checks, consumers who pay with eChecks typically know when their money will leave their account—within three to five business days. After you authorize the payment, it usually takes 24 to 48 hours for the funds to be confirmed in your account. Your eCheck will “bounce” like a regular check if you don’t have enough funds.

How can I cancel an electronic check?

If you own a business, you might need to ask a customer to cancel an eCheck. Depending on the payment system you’re using, and the transaction stage, the specific steps for doing will vary.

You will need to arrange a refund if the payment has already been deposited into your account and you want to cancel the electronic check. Get in touch with your payment processor to determine the best course of action if the payment is still outstanding.

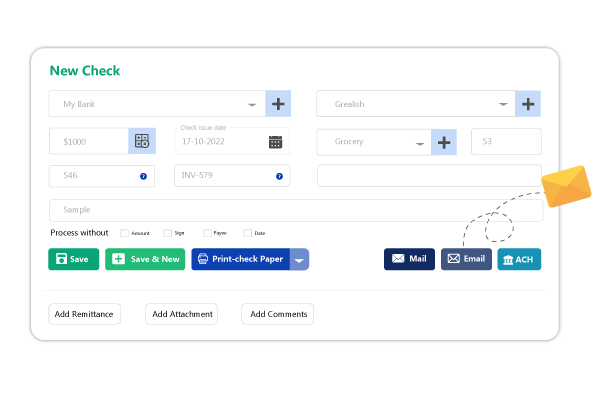

Zil Money is one of the best platforms for sending and receiving printed checks, eChecks, and recurring eChecks by email and SMS. Additionally, change a received paper check into an electronic transfer using the information on the check. Print the received eCheck as a single printable PDF file. Print it on plain check stock sheets or white paper using our platform. Our platform offers a free payment alternative called Pay with eChecks that provides all the benefits of a paper check, and you can also send eChecks as an ACH transfer.