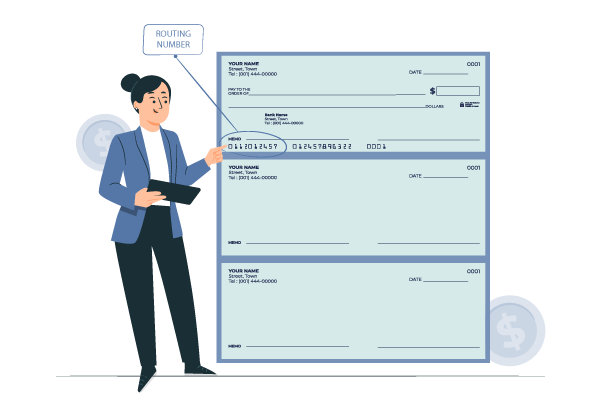

Maintaining an up-to-date bank routing number is a critical yet often overlooked aspect, especially in check transactions. Overlooking this seemingly minor detail can lead to significant consequences, potentially affecting financial stability. Ensuring that the banking routing number on check is accurate and updated is a vital step in safeguarding financial security and maintaining a reliable financial profile.

Click Here To See The Interactive Demo

Bounced Checks

The bank compares the account number with the routing number when the cheque is given for payment. Checks that have incorrect or invalid routing numbers may be rejected, which could cause the transaction to fail. A situation like this damages a person’s credit report and costs the bank and the payee a lot of money.

Late Payments and Fees

When utilizing checks to settle bills like rent, utilities, or credit cards, the use of an outdated routing number may lead to the imposition of late fees. These penalties for delayed payments can adversely affect credit scores and overall financial standing. To avoid these consequences, it’s crucial to update the routing number whenever it changes.

Strained Relationships

Whether dealing with personal or professional transactions, having checks bounce due to an outdated routing number can strain relationships. It can erode trust with friends, family, or business associates who rely on payments.

Missed Opportunities

Within the business realm, late payments or declined checks could result in missed opportunities. Future collaborations with partners, suppliers, and vendors may become less likely for someone with a track record of payment issues. This may hinder one’s ability to progress and succeed in both personal and professional endeavors.

A Resolution to Mitigate Challenges

Zil Money stands as an advanced financial platform, offering a solution to avoid the challenges associated with the use of outdated routing numbers. The platforms provide real-time verification of routing numbers. This feature ensures the smooth transfer of payments and helps in preventing errors. The digital platform guarantees secure transactions through the implementation of strong security features. The platform offers a user-friendly interface for both individuals and businesses to efficiently manage funds. The platform’s design minimizes the risk of errors, especially those stemming from outdated routing numbers, and simplifies processes.

While the act of updating bank routing numbers might appear to be a minor task, neglecting it could result in significant consequences. The impact extends beyond mere inconvenience, encompassing financial penalties, bounced checks, strained relationships, and potential legal issues. Regularly reviewing and updating banking information can avert the challenges associated with outdated routing numbers on checks, maintaining trust and facilitating smooth financial transactions.