Constantly having to make loan requests for borrowing money is a significant inconvenience for businesses. Businesses are increasingly drawn to credit facilities for their financial flexibility. The cloud-based platform offers businesses the option to access credit facilities, repay them with interest over time, and borrow as needed without constant loan requests. Additionally, it enables businesses to make purchases without cash constraints, providing financial flexibility and support for operational needs.

The Flexibility of Credit Facilities

Credit facilities are crafted to provide businesses with the flexibility required to manage their cash flow effectively. Unlike conventional loans that disburse a large sum at the start, credit facilities enable businesses to access funds as necessary. Real-time availability ensures that businesses have the financial support precisely when they require it. This can be for covering operational costs, or capitalizing on growth prospects.

Convenient Repayment Options

Zil Money’s lending facilities provide businesses with the necessary funds and flexible payback alternatives. The flexible options offered by the software enable organizations to tailor their repayment schedules in accordance with their cash flow cycles. Furthermore, the platform’s automated reminders and notifications assist firms in staying organized with their payments. This simplifies administrative work and fosters good financial management.

Eliminating the Need for Constant Loan Requests

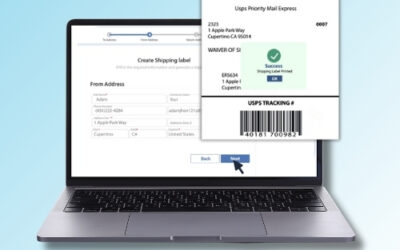

Credit facilities provided by Zil Money avoid the time-consuming paperwork, and approval delays typical of traditional loan processes. Instead, they offer businesses a quick and accessible funding source. With a user-friendly interface and simplified procedures, the platform makes borrowing efficient. This saves businesses time and resources.

The platform’s credit facilities are revolutionizing how businesses handle their financial operations. This is supported by its innovative features and user-friendly interface. By granting instant access to funds and enabling growth initiatives, the software is reshaping the landscape for businesses. It also offers adaptable repayment plans and reducing the need for frequent loan applications. The platform also provides ACH, wire transfer, printable checks, eChecks, and RTP at an affordable rate. With the platform businesses can tackle financial hurdles effectively and explore fresh paths to success.