Despite the increasing number of online transactions, mistakes involving check routing numbers remain surprisingly common. These errors can lead to delayed transactions, bounced checks, or even unauthorized payments. There are some ways to avoid making mistakes in the check routing number.

Click Here To See Interactive Demo⬇

Reasons Behind Check Routing Number Mistakes

No Familiarity with Routing Numbers

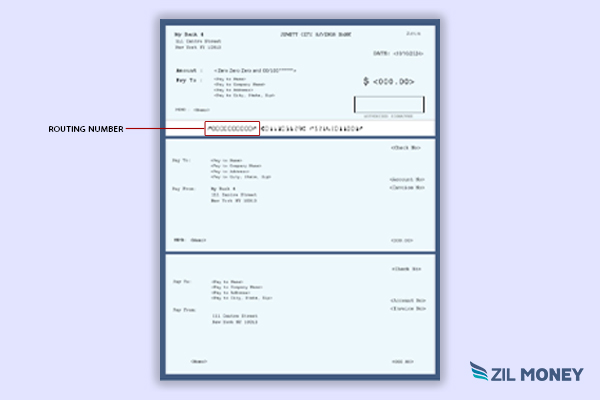

Routing numbers, also known as ABA numbers, are unique nine-digit codes given to financial institutions. Many individuals are unfamiliar with their purpose, which leads to confusion. People may memorize account numbers, but routing numbers are often overlooked until needed for a transaction.

Human Error in Manual Entry

Manual entry of a nine-digit number increases the chances of errors, such as transposing digits or omitting numbers. These simple mistakes can disrupt transactions when double-checking is not done. In some cases, bad and illegible handwriting on checks adds another layer of confusion when information is being processed.

Misunderstanding Different Types of Numbers

Checks contain multiple numbers that contain 8-12 numbers, including the routing number, account number, and check number. Small businesses and individuals unfamiliar with these differences may incorrectly remember or use the wrong number. For example, some might use account numbers instead of check routing numbers as both are slightly similar.

Relying on Outdated Information

Financial institutions may change their routing numbers due to mergers, acquisitions, or rebranding. Customers who rely on old checks or outdated online information can unknowingly use an incorrect routing number.

Neglecting Verification Steps

Some payers skip verification steps, such as confirming routing numbers with their banks or reviewing forms. Neglecting this simple precaution can lead to high complications.

Dependency on Outdated Technology

Some businesses and individuals still use paper-based systems that do not automatically validate routing numbers. This increases the risk of errors and reduces the chance of catching mistakes before submission.

How to Avoid Check Routing Number Mistakes?

To avoid the above mistakes related to check routing numbers it is better to create and print checks on your own. Zil Money allows you to issue checks from home, office or while traveling. The platform’s online check printing feature allows you to print routing numbers, account numbers, and check numbers at the bottom of checks. Users do not need to worry about outdated checks or routing numbers being changed; you can easily edit them whenever needed.

How Zil Money Helps You Create Checks

1. The drag-and-drop feature allows you to customize checks without any prior design experience. Users can easily design a check template and save it for the future. The platform provides free pre-designed check templates for instant use like payroll, bill, landlord, vendor, supplier payment, etc.

2. The Check 21 Act permits you to print checks on blank check stock with a standard printer. The platform allows you to reduce check printing expenses by 80% by switching to on-demand check printing.

3. Checks generated using the software can be securely sent to recipients without any manual assistance. The platform handles the printing, labeling, enveloping, and mailing of checks at an affordable rate, all completed on the same business day. These checks are dispatched via trusted mail partners—USPS and FedEx. Users can send multiple checks to different recipients simultaneously in less time period.

4. If your vendor prefers payment via checks, but you’d rather make a digital wallet or bank transfer, the platform offers solutions without any hidden fees. The software offers check payments from checking accounts, credit cards, digital wallet, or the cloud bank. Businesses can give priority to payee preference without having any burdens of extra processes.

5. Zil Money provides a positive pay feature to ensure maximum security for your checks. Positive Pay allows you to pre-authorize your bank with details of issued checks, ensuring only approved checks are processed. The platform sends your company’s issued check details to the bank via API, FTP, or Excel sheets. The financial institution immediately notifies the bank if you cancel or void a check and eliminates the need for manual updates.

Why Check Payments via Credit Card for Businesses?

- Even during tight cash flow, when your payee requests checks, you can send them a check mail via credit card.

- The platform eliminates payee charges on credit card transactions. Vendors, suppliers, and employees can receive payments without worrying about the hidden charges.

- Users can earn rewards, discounts, and cashback on credit transactions and use them later for business or individual activities.

- The software allows you to make payments via credit cards, such as ACH, wire transfer, virtual cards, and check mail.

- You can easily integrate your payroll software with the platform and make payroll payments via credit card to pay employees simultaneously without trouble.

In conclusion, mistakes with check routing numbers can happen for various reasons, such as confusion over account details, manual errors, or using outdated information. To avoid these issues, it’s important to double-check routing numbers, keep them updated, and take advantage of tools that make the process easier. Zil Money allows businesses and individuals to print checks from home or office with correct, customizable details, ensuring fewer mistakes and quicker payments. With the ability to send checks securely and conveniently, this can save time, reduce errors, and help keep your finances in order.