It’s easy to find the account and routing number on check, all checks have the account number written at the bottom of them. You might not think much of it, but did you know that those numbers are also used to verify your identity when you make a deposit or transfer money? There has been some discussion lately on whether or not to make the routing number on a check confidential. We will discuss this in the coming section. Zil Money, a cloud based online platform, lets you print your account, check, and routing number on your check instantly on demand.

Click Here To See The Interactive Demo

Check Overview

Checks order banks to pay their owners. The “payer” or “drawer” is the person who writes the check. The check is given to the “payee.” It is simple to cash a check or deposit it into a bank account. The transaction record benefits both the payer and the payee. Checks are legal documents, so they should be handled with care.

The Most Important Component of a Bank Check

Bank routing number

The routing number, also known as an ABA (American Bankers Association) routing number, is a string of nine numbers used by U.S. banks to identify particular financial institutions. This number shows that the bank is either chartered by the federal government or by a state government.

Large multinational banks may have multiple routing numbers, typically based on the state in which your account is located. Routing numbers are frequently required for reordering checks, paying bills, establishing direct deposit (such as a paycheck), and paying taxes. The routing number for domestic and international transactions will differ. The routing number for domestic and international transactions will differ.

Account number

The account number is a series of numbers that the bank uses to determine which accounts to debit when you make a payment. If you have multiple accounts at the same bank, each account will have the same routing number but a unique account number.

The routing number of a bank is discoverable, but your account number is unique to you. It is therefore important to safeguard it similarly to your social security number or PIN code.

Using OnlineCheckWriter.com, you can print your routing, account, and check number on blank stock paper or white paper.

Check number

A check number allows you to keep track of each written check. The vast majority of check numbers consist of three to four digits, making them the shortest. Routing and account numbers are more useful for the electronic transfer of funds than check numbers.

Is it Okay to Disclose Your Routing Numbers?

The routing number is not private. It is frequently displayed on bank websites. This is because even if someone were to obtain your routing number, they would be unable to use it.

It’s similar to telling someone where you live. This insufficient information cannot be used to locate you, so it is harmless. Your account number, on the other hand, is private. This number allows access to your account and the ability to transfer funds. Ensure that your account number remains secure so that no one can use it.

Uses of Routing Numbers

Your routing number is often used when you make your first purchase or if you’re making a purchase or payment by phone or online. You’ll need to provide both numbers, so the money knows where to go. Additionally, a routing number is needed if you are processing checks or handling international payments.

A routing number is something that most people know. You don’t need to feel bad about giving it out. Most people use their routing and account numbers together when making purchases. If you can find one, you can easily find the other.

A bank routing number is not difficult to find if you know where to look. Now that you have it, you will be able to understand what it is used for whenever someone asks for it.

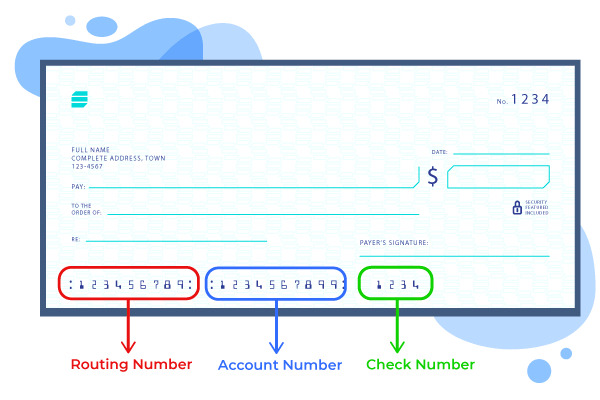

Account and Routing Number on Check

Checkbooks, which are made specifically for your bank, include their routing number. The routing number on check is usually found at the bottom left corner of your check, near where all the numbers are situated. The routing number is the bottom leftmost nine digits on the check, and it will be the same for everyone on your bank check. That is, your routing number on check will be the same throughout.

An account number is a unique identifier for each account at a bank or other financial institution that you have. After the routing number comes the account number, which typically has eight to 12 digits, and the check number, which is the last set of digits on the right (usually consisting of three or four digits).

It is clear that check routing and account numbers play an important role in verifying a person’s identity when making deposits or transferring money, so it is essential to keep them secure. Zil Money has made it easier than ever to print out your account and routing number on checks securely. Print any type of check instantly on-demand without wasting any of your precious time or money.