In a world where financial transactions are increasingly digital and instantaneous, the risk of check fraud remains a significant concern for businesses of all sizes. One effective solution to safeguard your company against check fraud is Positive Pay which protects your company from check fraud. By choosing ZilMoney.com as your partner, you can benefit from its automated service, eliminating the need for manual intervention and enhancing the overall security of your business transactions. In this blog, we will explore the concept of Positive Pay, its advantages, and how the platform’s innovative solution can help streamline the process for you.

What Is Positive Pay?

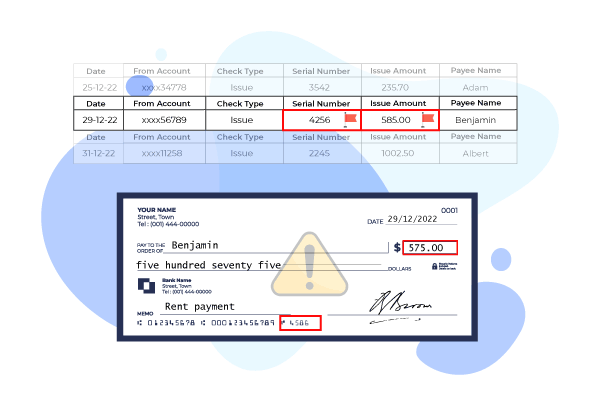

Positive Pay is a fraud prevention mechanism that allows businesses to inform their banks about issued checks in advance. As a result, the bank only clears checks that match the information provided by the company. This includes the check number, account number, and dollar amount. Checks that don’t match these details are returned to the issuer, ensuring that your business doesn’t lose money due to fraudulent payments.

Positive Pay With ZilMoney.com

With ZilMoney.com’s automated Positive Pay service, overseeing the checks your company has issued becomes effortless. The platform lets your business transmit the issued checks to your bank via API, FTP, or Excel sheet upload. This eliminates the need for manually notifying banks each time you issue or cancel a check. Instead, the cloud-based software will inform the bank immediately when you cancel a check, voiding it immediately. As a result, you can have peace of mind and focus on running your business when the all-in-one platform handles everything.

Benefits Of Positive Pay

Complete fraud detection:

Positive Pay provides comprehensive fraud detection by matching company-issued checks with those presented for payment. A check that doesn’t contain the correct identifying information will be returned to the sender. This ensures that your business is not at risk of losing money due to fraudulent activity on your account.

Timely notifications:

If a check doesn’t match the provided check number, account number, or dollar amount, the bank can flag the check and notify a representative from your company. The bank may also ask permission to clear the check if it is valid. This prompt notification allows your company to address potential fraud quickly and efficiently.

Enhanced security:

Sometimes, the company includes the payer’s name in its system, but this name is not included in check matching. With Zil Money’s Positive Pay, you can add an extra layer of security by ensuring that only authorized payers can issue checks from your account. This significantly reduces the risk of unauthorized transactions and fraud.

Streamlined processes:

By automating the Positive Pay process with ZilMoney.com, your business can save time and resources previously dedicated to manual check management. As a result, you can efficiently manage your company’s issued checks and focus on more critical aspects of your business.

Improved cash flow management:

Positive Pay helps you monitor and control your company’s cash flow more effectively. This allows you to better manage your account balances and financial health by preventing fraudulent payments.

Conclusion

Positive Pay is essential in the fight against check fraud. By partnering with ZilMoney.com, your business can benefit automatically, saving time, resources, and, ultimately, your company’s hard-earned money. Protect your business from check fraud with Zil Money’s innovative Positive Pay service and gain peace of mind knowing that your financial security is in good hands.