Pay Your Vendor with Credit Card

No payee fees

Accept Payment by Credit Card

Easy, Affordable, No Card Reader Needed

Happy Customers

New Customers a Week

Transactions Per Week

Bank Draft Definition

Bank Draft, also called Demand Draft or Check Draft, is made by the vendor, and approved by the payer or account holder. In short, a regular check is made by the bank account holder with the signature included on it. The merchant can make the check draft with approval from the account holder without a signature. Moreover, it can use as a payment method, just like a check. Unlike checks, the issuing bank is guaranteed for check draft. Bank Drafts provide the payee with a secure form of payment.

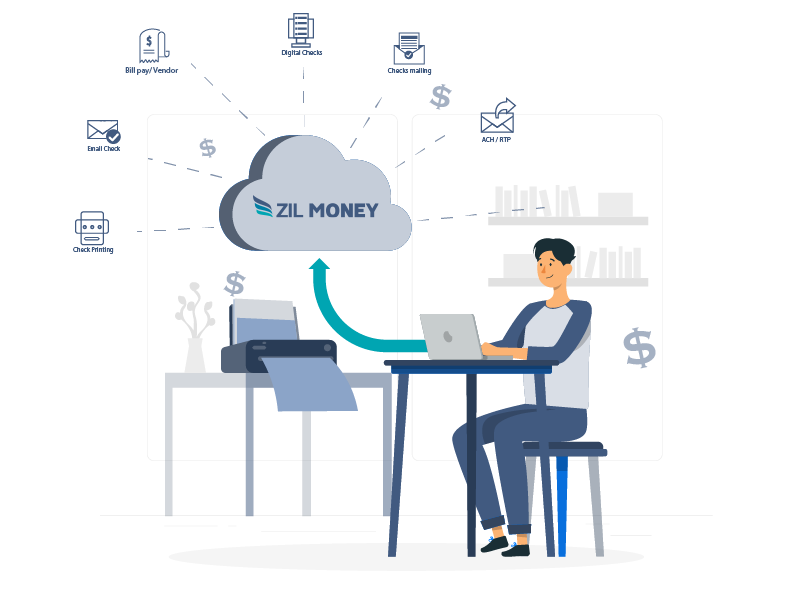

FEATURE AP/AR

Check Printing

Instantly create and print yourself on any printer. Drag & Drop Design

Pay By Credit Card

Now pay by credit card even if they don’t accept them.

Cloud Bank

Open an online bank account with no hidden charges.

Check Mailing

One-Click Check mailing for $1.25 by USPS/FedEx without leaving your desk.

ACH / RTP

Send ACH/RTP in one click. Get paid by ACH. Make it one time/recurring

Wire Transfer

Transfer money electronically from one financial institution to other.

Email Check

No Printer/Paper? Email a One-time printable & trackable PDF Check.

Digital Checks

Convert paper checks to paperless Digital Checks & send to email/Text.

Integration

Integrate with the top third-party applications.

Deposit Slips

Instantly create & print deposit slip of any Bank. Keep track & auto reconcile it

Payment Link

Get paid by Button/HTML form on your site or Link to text or email.

Bank Data

Connect & reconcile, Categorize from Any Fina-Institution automatically

Bill Pay / Vendor

Pay Bills Online, Schedule it, Manage suppliers Smart, and reduce risk.

Invoicing

Professional invoicing, email with payment link, track & manage.

User / Approver

Role-Based user and approval process. Accountant/Client access.

API / White Label

Interactive developer friendly API. Complete white label solution.

Bank Draft by Phone

Bank Draft is acceptable over the phone; no need to wait for checks to arrive in the mail from your client. Enter your client’s information into the software, including bank routing numbers and account numbers. Then you print the check by any printer on their behalf with their authorization. This check comes without a signature, and it states, ‘No signature required and approved by the depositor.’ Deposit this check draft to the bank like you deposit a regular check. You can do it for a one-time payment or recurring payments. Also, you are open to various payments according to the agreement you have with your clients.

Exercise the latest options to get paid on top of the check draft. Send a link to your client’s phone or email and let them fill up the bank information and sign on it.

How Do Bank Drafts Work?

The bank draft process is easy. An individual visits a bank and gives instructions for a bank draft. The bank then transfers the appropriate amount from the individual’s account to its own. The bank draft follows the customer’s amount and payee instructions. The paper lists the payee and amount.

CROSS PLATFORM SUPPORT

Use the application on your desired platforms. Install the application on your mobile devices and enjoy the features from anywhere at anytime. A user-friendly platform to manage all your financial aspects under one roof from your smart devices.

All In One Platform

Zil Money is a one-stop shop for personal and business finance. Zil Money’s platform offers several services and tools in one place. Zil Money streamlines money management by organizing transactions, payments, costs, and reports. ACH transactions, wire transfers, eChecks, and bank drafts are available on the platform for flexibility and convenience. Zil Money’s configurable invoicing, budgeting tools, and accounting software integration improve productivity and organization.

FREQUENTLY ASKED QUESTIONS

What's bank draft?

Are bank drafts safe?

Bank Draft vs Check

Bank Draft vs Certified Check

PRECIOUS REVIEWS FROM

OUR CUSTOMERS

Vendor Management: Easily handle bill payments, instant check printing and mailing, invoicing, positive pay, and access User/API features across various platforms.

User-Friendly Interface: Zil Money's interface is intuitive and easy to navigate, making it accessible for users of varying technical proficiency.

Ana

Ease of deployment and use. Normally, a switch like this is both time-consuming and confusing, but in this case, it was super easy.

Jennifer

The dashboard and the customer support are amazing! Never has a company been there like Zil Money and answered all my questions before letting me go. Thank you.

Stephanie

I love that I am able to process payments and do ACH transfers very easily.

Ardinay

Total Money Moved

9,520,030,217 +

Total People Paid

1,020,421 +

Total Businesses Satisfied