Traditional financial instruments are undergoing a transformation, and one such instrument that has adapted to the changing landscape is the Demand Draft. Demand Drafts, once synonymous with physical paperwork and manual processing, have efficiently integrated into the digital realm, offering greater convenience, efficiency, and security.

Digital Advancements

Online Application and Generation

In the digital age, customers can initiate the process of creating a Demand Draft from the comfort of homes. Most banks provide online platforms or mobile apps that allow users to fill out the necessary details, specify the payee, and generate a digital Demand Draft.

Electronic Authorization

Gone are the days when individuals had to physically visit banks to authorize the issuance of a Demand Draft. With digital signatures and secure authentication methods, customers can now electronically authorize the creation and release of a DD.

Instant Processing

Digital Demand Drafts significantly reduce processing times. Once the necessary information is provided and authorization is obtained, the DD can be generated instantly. This has proven to be beneficial for businesses and individuals requiring quick and secure fund transfers.

Integration with Digital Banking

Many banks have integrated Demand Draft services into digital banking platforms, allowing customers to manage and track DDs alongside other financial activities. This integration enhances accessibility and ease of use.

Enhanced Security Measures

Digital Demand Drafts uses advanced encryption technologies to ensure the security and confidentiality of the transaction. The use of secure channels for data transmission minimizes the risk of unauthorized access

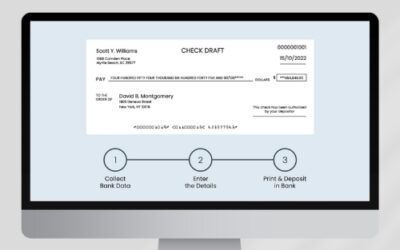

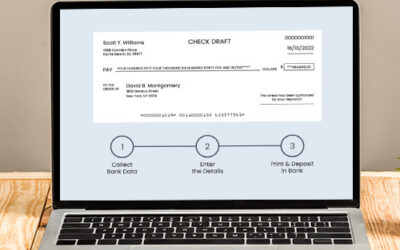

Digital Transformation

Zil Money, a well-known digital platform, has completely changed how financial transactions, including Demand Drafts, are managed. The platform is a great option for individuals and organizations since it blends the security of traditional financial instruments with the convenience of digital technology. The platform maintains a detailed and transparent audit trail of all transactions, providing a comprehensive record of every step in the Demand Draft process. This not only enhances accountability but also simplifies reconciliation. The platform’s user-friendly interface ensures that users, whether individuals or businesses, can easily navigate the platform. From creating a digital Demand Draft to tracking its status, the intuitive design makes the entire process easy. Digital Demand Drafts on the platform can be initiated and received from anywhere with an internet connection. This accessibility ensures that financial transactions are not limited by geographical boundaries, promoting inclusivity in the global economy.

The integration of Demand Drafts into the digital age represents a substantial advancement in terms of efficiency and security. Businesses and individuals can now enjoy the benefits of this traditional financial instrument without the limitations of physical paperwork and geographical constraints. As we continue to witness the evolution of financial technology, the role of digital platforms in enhancing transactional processes is becoming increasingly apparent, paving the way for a more interconnected financial future.