The financial world is full of technical terms, and one term you may have come across is the ABA number or routing number. In the United States, every financial institution is given a unique ABA number, which is used to identify the bank during financial transactions like wire transfers, direct deposits, and electronic payments. Use your account and ABA number and initiate a money transfer using Zil Money.

What Are ABA Numbers?

Every financial institution in the United States is given a unique number called an ABA number. It is also called a routing number and stands for the American Bankers Association number. This code is used to identify the bank when processing financial transactions like wire transfers, direct deposits, and electronic payments.

The nine-digit ABA number of a bank is used with the account number to find a specific bank account. The American Bankers Association gives every bank in the United States an ABA number. When banks send money through the Federal Reserve System, this number is used to identify the bank.

Is There a Distinction Between an ABA and a Routing Number?

An ABA number and a routing number are the same things. So, the terms are often used interchangeably to talk about the same nine-digit code used in the United States to identify financial institutions.

The American Bankers Association (ABA) gives out both ABA numbers and routing numbers. These numbers are used to send money to the right bank for a wire transfer, ACH payment, or other electronic transaction. These codes are unique to each bank or credit union and are used to ensure that money goes into or out of the right account.

Some people use the term “ABA number” to mean the code that tells which bank an account belongs to, but this is not technically correct. Most of the time, the term “routing number” is used to talk about the code used to send money to a specific bank. However, both terms can be used to talk about the same code.

The modern financial system would only work with ABA numbers. They give each financial institution in the United States a unique identification code, which helps ensure that financial transactions are correct and stops fraud. By knowing how ABA numbers work and why they are important, you can be sure that your financial transactions are handled correctly and safely.

How Can You Find an ABA Number?

You can find an ABA number (also known as a routing number) in a few different ways:

- Check your bank statement: Your ABA number should be listed on your bank statement, usually near the top.

- Look online: Most banks and credit unions have their ABA number on their website. Check the “Contact Us” or “About Us” page for this information.

- Contact customer service: You can call your bank’s customer service line and ask for the ABA number.

- Use the ABA’s online routing number lookup tool: The American Bankers Association (ABA) offers an online tool to search for routing numbers. You can enter the name of your bank or credit union and its location to find its ABA number.

It’s important to note that some banks and credit unions may have multiple ABA numbers, depending on the region or type of transaction. So, it’s always a good idea to double-check the ABA number with your bank or credit union before initiating a transaction.

How Can Zil Money Help You?

Print routing or ABA numbers from the comfort of your home or office without wasting your time or money using Zil Money. You can design and personalize your check by adding your company’s logo and other information. You can also write and print checks on regular or blank paper using our platform Zil Money. Finally, print the check, account, and routing number (Banks ABA number) of any of your banks without wasting your time or money.

You can also create and send digital checks or eCheck via email or ACH network using our platform Zil Money. You can also mail the check with a click from your devices. Upon clicking, we will print the check and send it through the mail, all for a reasonable cost.

Is ABA Number Printed On Check?

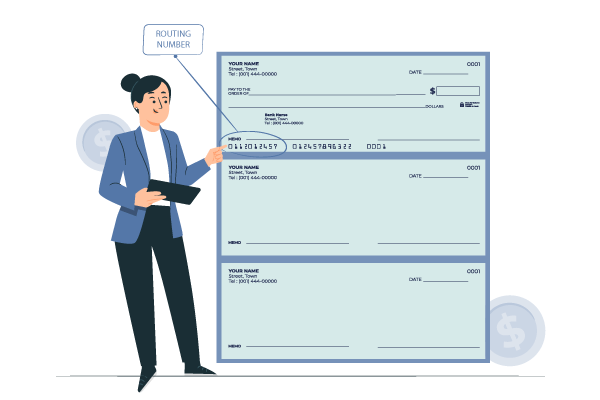

Yes, the ABA Number is printed on checks, usually in the lower left-hand corner. It is the first nine-digit number located at the bottom left-hand side of a check, followed by the account number and check number. The ABA number, also known as the routing number, identifies the financial institution that issued the check. So if you have a check from your bank, you can find the ABA number.

ABA numbers or routing numbers are crucial for the smooth functioning of the financial system in the United States. They provide each financial institution with a unique identification code, which helps to ensure that financial transactions are carried out correctly and safely and prevents fraud. So, if you are looking for a platform to transfer money, then look no further than our platform Zil Money.