In today’s digital economy, money transfers can be tedious and time-consuming, but not with the Automated Clearing House (ACH) network. The ACH network has become an increasingly popular way to transfer money from one bank to another. Zil Money provides this ACH transfer service at a reasonable cost. Keep reading to learn more about the basics of ACH transfers, how they work, and their convenience and security.

ACH Network

The National Automated Clearing House Association (NACHA) is in charge of the ACH network. The ACH network is used for direct deposit and direct payment. ACH transactions include recurring and one-time payments, government, consumer, and business-to-business transactions, foreign payments, and information about payments. Businesses also use ACH to pay for online and phone orders, as well as to charge credit cards directly to customers.

What Is an ACH Bank Transfer?

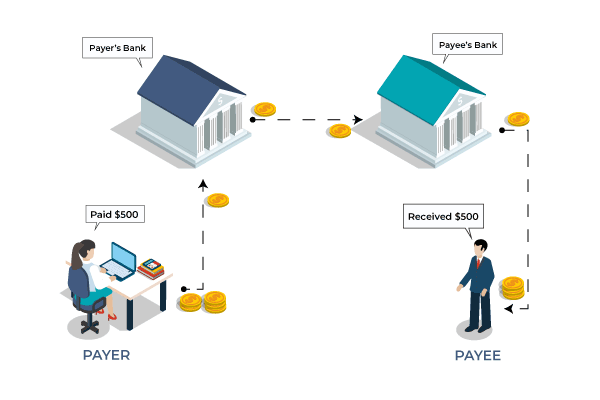

When you transfer money from one bank to another, you use the Automated Clearing House network. ACH transfers are a type of electronic payment. People frequently use them to automate direct deposit and bill payments.

Types of ACH Transactions

The ACH network is composed of two distinct types of transactions:

- ACH credits

- ACH debits

ACH Debits

An ACH debit is not the same as a credit card purchase. An ACH debit withdraws funds from the account being paid. This indicates that the payee—the person receiving the money—is the one who initiates the payment.

Companies frequently use ACH debit when someone owes them money. Instead of “ACH debit,” these companies may refer to this as “autopay” or “ACH.”

ACH Credits

ACH credits must be authorized by both the payer and the recipient to be processed. When both parties’ authorizations are complete, the entity initiating the ACH credit will instruct its bank to send the money to a specific account. The transaction can be done manually or set up as a recurring payment with ease.

How Long Does an ACH Bank Transfer Take?

ACH bank transfers take a few days to complete; the transfer takes about 3-5 business days. This is due to the fact that, unlike wire transfers, which are sent in real time, the ACH network sends payments in batches. ACH credits can be delivered and processed in one or two business days by financial institutions processed the following business day. Zil Money provides ACH transfer for a reasonable price.

Same-Day-ACH

NACHA tried to get banks to offer fast services in 2010. Some people didn’t like the idea because it took so long to catch on. Some people who work for the bank say that the new services won’t be offered. Same-day ACH was started by NACHA. Almost all types of ACH payments, like debits and credits, will be able to be processed on the same day.

Following consideration of member feedback, NACHA has suggested new possibilities for Same-Day ACH reconciliation. The following is included in the proposal:

- Debit and credit card transactions are settled three times a day: in the morning, in the middle of the day, and at the end of the day.

- Same-day settlement is not an option if you are selling your home overseas or if it costs more than $25,000.

- All institutions that would be receiving the money (banks, etc.) would have to update their systems.

The originating institution (ODFI) will be charged a predicted fee for these updates based on the inverse relationship between the two numbers. This fee will go down as the number of transactions goes up.

ACH Security

NACHA wants businesses that start ACH transactions and third-party processors to follow protocols, processes, and controls to keep sensitive information safe. Their rules also say that any banking information, like account and routing numbers, must be sent using safe technology.

If you use an email that is not secure or a web server that is not properly protected, you won’t be able to send or receive bank information. Make sure that your ACH payment processor is using strong encryption and the most up-to-date methods. A part from this Zil Money also provides you with additional security so that all your data will be safe.

If you’re looking for an affordable and convenient way to handle your financial transactions, Zil Money is the solution for you. With our easy-to-use platform, you can do ACH transfers between clients or payees on a one-time or recurring basis. You can also use Zil Money to pay bills and payroll, making it the perfect all-in-one solution for your business’ finances. Ready to get started? Sign up today and experience the ease of using Zil Money!