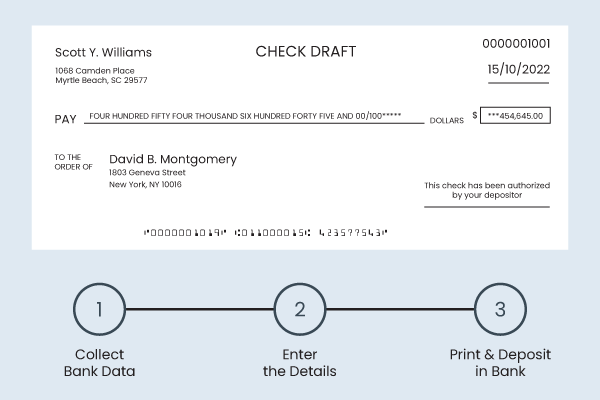

You can use Zil Money to print bank or check drafts with only a few clicks or taps from your devices. Any device with internet connectivity can use the service. You can make a payment without leaving your house thanks to the Instant Check Draft from Zil Money. Your payment will be handled shortly once you provide the recipient’s details and the desired payment amount. Your transaction will be handled soon.

Check Draft Overview

Check drafts are a kind of payment available to bank customers. Essentially, these are ones that the vendor issues with the customer’s consent. The check can be signed by someone other than the consumer to be accepted. It can be used the same way as standard checks. The primary distinction is that the issuing bank guarantees check drafts. This offers a risk-free and secure payment method to the payee or merchant. The customer’s account is deducted while employing this approach once the check is provided for payment. So, even if the check is stolen or misplaced, there is no threat of paying NSF costs.

To use a check draft, banks frequently impose a charge. This is particularly true if they ask you to complete a number of transactions to transfer the money or if you are carrying out a single transaction that entails transferring money from one account to another. Depending on the type of bank and how long you have to wait for the funds to become available, the fee amount will change. You can print an unlimited number of check drafts for free using Zil Money.

Advantages:

- Beneficial for Large Transactions: A certified check is an excellent way to ensure that a significant transaction goes smoothly.

- Usefulness: It is easy to use, and it helps transactions go smoothly.

- Authenticity: A bank draft is a very reliable way to transfer money because the bank only issues the draft after completing all the required formalities.

- Risk: There is minimal risk involved in this type of draft.

Disadvantages:

- Time-Consuming

- Cost

All these disadvantages can be eliminated if you are using Zil Money to print your check draft, you will get it instantly without any fees.

Checks vs Check Drafts

A bank customer issues a check, yet there is no bank guarantee that the check will be honored as payment. This indicates that there is a chance the check will bounce for a variety of causes.

In contrast, a check draft is issued and guaranteed by the bank. This signifies that there is no chance that the check bounced because the consumer pre-deposited the money. An IOU from one bank to another is what a check draft is.

When bank customers want to make significant payments, the bank produces check drafts. Although a certificate does not need to be signed, a bank representative must do it in order to make it more safe and fraud-proof.

Types of Check Draft

- Money Orders: This type of check draft is where funds are transferred from one location to another. The bank does this on the client’s behalf. It’s a financial product where the bank guarantees to repay the money if it’s sent to them earlier.

- Certified Checks: When moving money between two financial organizations, a certified check is the type of check that is utilized. The bank must pay for this service. It is the most practical way to transfer money.

- Demand Draft: Demand draft is a payment request that does not include the payer and recipient in the exact location. Once they deposit it, the recipient obtains the funds used for routine financial activities.

Check Draft & Check Draft by Phone Using Zil Money

A check draft or remotely generated check can be printed immediately using Zil Money. As long as you have permission from the person who will pay you, customers can use Zil Money to print it immediately. You can deposit the check in the bank without their signature. Additionally, the software is free to use for routine check creation.

Now, you can take checks from customers over the phone. You will need their checks to arrive in the mail, saving you time. Choose a template and enter your client’s information, including their bank account and routing numbers, and print the checks on their behalf. The depositor will not sign the check, but they will still give their approval.

Overall, check drafts are a great way to get paid without having to go through the hassle of signing and mailing a check. With Zil Money, you can print check drafts immediately if you get authorization from the person who will pay you. You can also print checks using our. So, next time someone asks for your payment information, consider using a check draft!