Do you need assistance keeping track of all your bank data, credit card bills, and other data required for bank reconciliation? If so, don’t worry; switch to Zil Money to access your bank information in one location. You know how vital it is to monitor your finances if you own a business. Automating reconciling bank accounts is among the best methods for accomplishing this. Although this procedure can be carried out manually, automating it can typically be done considerably more quickly. Zil Money is one such service that will save you time. Our technology will automatically gather your bank information, centralizing it for automated bank reconciliations.

What is Reconciliation Bank Accounts?

Your bank statement or bank records are “reconciled” when you compare them to your bookkeeping records for the same time period and note every inconsistency. You then keep track of these disparities so that you or your accountant may be certain that no money has “vanished” from your company.

Bank reconciliations aren’t simply for your personal accounts. To find and resolve any irregularities and ensure that all transactions are properly recorded throughout all records, the bank reconciliation process entails comparing transactions between the accounting records and bank statements. A basic accounting procedure is carried out each month as part of the monthly process for reconciliation.

Why Reconciling Bank Account Important

Although bank reconciliations can be time-consuming, practicing good financial hygiene will pay off. Here’s why carrying them out is a terrific idea.

- To see your business as it is.

- To track cash flow.

- To detect fraud.

- To detect bank errors.

- To stay on top of accounts receivable.

When you perform bank reconciliation, you first identify the transactions to blame for discrepancies between your books and your bank account. You can match balances using these data. All you have to do next is document the steps you took to match the balances.

Important terms for you to know:

As long as you maintain track of them, having unpaid checks, unpaid withdrawals, or unpaid deposits and receipts has no negative effects.

- Outstanding check/withdrawal. This is a check or money transfer that you’ve written, recorded, and are still waiting to clear.

- Outstanding deposit/receipt. This is referred to as “deposits in transit.” These funds were given to your business and recorded on the books, but the bank still needs to process them.

What is Automated Reconciling Bank Accounts?

While manual bank reconciliation involves checking and comparing accounting records and bank statements, automated bank reconciliation uses technology or software to accomplish this task.

The reconciling bank accounts process is usually completed by humans, which makes it repetitive and prone to mistakes. Using technology or software that employs automation algorithms, you can automate the bank reconciliation process with less need for manual labor and little oversight from humans. Businesses can improve speed and accuracy and free up their finance departments to work on other, more important tasks by automating a tiresome bookkeeping task.

How our platform Zil Money can help you with reconciling bank accounts

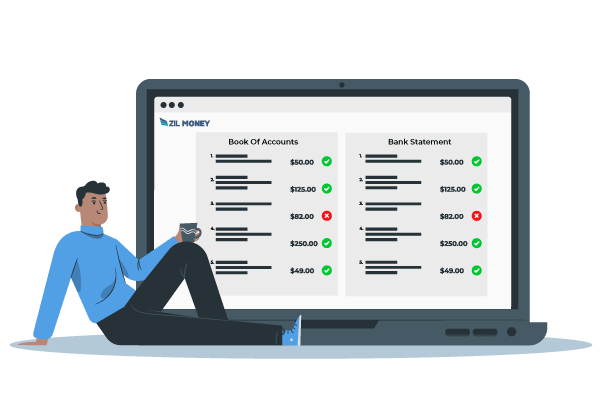

Never again struggle with manually creating bank reconciliations. Zil Money will take care of everything for you; using our platform, all of your recently introduced bank data will be instantly compared in one location. You can check the check number against the amount that was taken out of the account utilizing our online platform. Any fraudulent checks will not be allowed to enter the banking system.

Zil Money will be the best solution for you if you need to manage and view all of your bank information in one location and have various bank accounts. Having multiple account is not a problem anymore you can manage all your accounts in one place, Zil Money is integrated with 22,000+ banks, so you can easily incorporate all your bank accounts without wasting time. Using Zil Money you can access all your bank data online in one place and manage your finances using our finance management tools.

Our platform will let you automate reconciling bank accounts and view your financial information in one place. In addition to reconciliation, you can manage your business finances with several additional tools, including check printing, payroll and invoice management, internet banking, and many other advantageous features for your business purpose. So, try using Zil Money and experience the best bank reconciliation in the market.