Account Receivable is an important part of a business. Accounts receivable are the money owed by your customers. They are an essential part of a business’s finances, affecting how much it can spend on marketing and other business processes. Here’s how accounts receivable work, what they mean for companies, and how they might affect the price of the company’s products.

What Exactly Is Accounts Receivable?

Accounts Receivable is a term used in accounting to refer to the money a business receives from customers. It is an essential part of any business because it represents the money a business has collected from its customers. Accounts receivable is one of the most important factors in a company’s financial health.

Accounts Receivable are the money you have not yet received for goods or services delivered. Zil Money’s platform is designed to help collect this money and reduce credit losses.

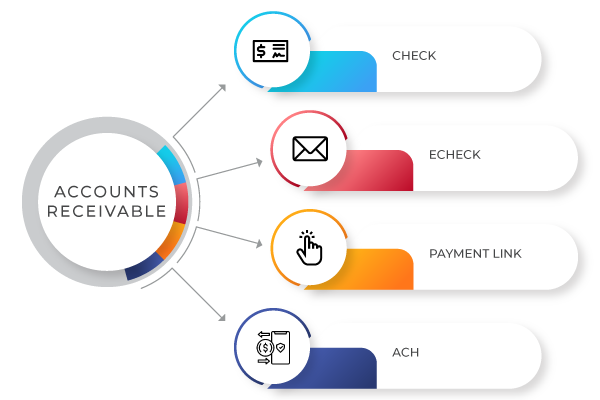

Accounts receivable are considered as current assets. This is the money customers owe the company. Businesses can use the platform to collect payments quickly. They can request eChecks, printable checks, ACH, and RTP payments.

The money owed from selling products or services is recorded as a debit in the company’s books. It is a payment solution designed for small businesses. It makes it easy to automate payments so businesses can spend less time on payment tasks and more time on their work.

Balance Sheet:

A company’s balance sheet shows how much money its customers have. The balance sheet also shows other important information about the company, such as its assets, liabilities, and how much money it has. Zil Money helps companies manage their accounts receivable by providing a secure platform.

Accounts Receivable vs Accounts Payable

There are two essential aspects of accounting:

- Accounts receivable.

- Accounts payable.

Accounts payable represent the money you keep, while accounts receivable is the money you are owed. With Zil Money’s easy-to-use payment platform, you can spend less time on tedious tasks like this and more time on your business.

Accounts payable are the amount of money a company owes to its vendors. Accounts receivable are the amounts of money that a company gives to others. Accounts payable and accounts receivable are both current liabilities on the balance sheet.

Some examples are:

Account Payable:-

Raw Material, Assembling, Traveling, Licensing, Leasing, Equipment, Logistics, and so on.

Accounts Receivable:-

Sale of Goods, Supply of Service, Deferred Revenue, Money Lending Industry, and so on.

Optimizing Cash Flow & Invoice

Zil Money and its subsidiaries offer practical, easy-to-use accounting and invoicing solutions that are perfect for small businesses and individuals. It is an excellent choice for Small and Medium Sized Enterprises (SMEs)that need an affordable way to enhance their accounts payable and accounts receivable activities. With this platform, you can get paid faster, waste less time, and have a better banking experience.

Streamline Your Account Receivable Process

Zil Money’s accounts receivable solution can help you quickly get the money you have to pay. This solution uses advanced positive pay and AI technology to remove any obstacles that might prevent you from getting paid on time. Plus, it offers your customers different ways to pay without delay. A clear understanding of how much money is coming in and out of your business will help you make better decisions more quickly.

Zil Money Overview

Most of the businesses like to print their checks instead of relying on a third party. There is no recurring fee and also accept checks by phone or mail. Also, accounts receivable can be made by using Check, eChecks, payment links and ACH.

Zil Money offers a fast, easy and flexible payment solution. Users can use any method to pay Credit, Debit, ACH, Checks, wallet-to-wallet, wire, etc. and keep their records accurate to improve their visibility and control.

Its payment platform makes it easy for small businesses to pay their bills. It automates the entire payment process, so users can spend less time on payments and more time on work.

Cross Platform Support:

Use Zil Money on a Desktop or a Smartphone. Customers could use both platforms to manage all their financial aspects under one roof from their smart devices.

All In One Mobile App:

Customers can now create customized checks very quickly with Zil Money. They have many different templates for checks, users can make as many checks as they want. After making the checks, they can send them by mail as digital checks to the receiver. The receiver can print out the checks if needed. There are no extra charges for digital checks.

Moreover, integration with 22000+ banks and financial institutions will enable users to connect multiple bank accounts and check formats on their platform. It helps detect fraudulent checks while supporting multiple banks and check formats. The platform has 1 million users, 4,000+ new customers a week, and 50,000 transactions per week.

Cloud-based technology allows clients to store checks on their servers. Many reputed companies and organizations like Coca-Cola, SUBWAY, American Red Cross, City of Columbia, UNITED WE LEAD Foundation, CEREDOWV Dot Gov, South Shore Support Services inc, use Zil Money for transactions.

Overall, Accounts Receivable is a crucial part of any business. By having an account with Zil Money, you’ll make the process of receiving payments much easier. People can use the app to improve their cash flow and make it easier to manage their accounts receivable. This app has all the features of the web application, so people can still work on their business even when they’re not at their computers.