Understanding the account number on a check is fundamental for seamless banking transactions. In addition, this unique identifier is vital for maintaining financial security and preventing unauthorized access. Zil Money, an innovative check management solution, can help you navigate this essential aspect of personal finance. With the platform, anyone can print high-quality checks easily at home.

Account Number on a Check

The account number on a check is a unique identifier like the check routing number assigned to your bank account by the financial institution. This number is essential for various banking transactions, such as depositing money, withdrawing funds, and making electronic transfers. Therefore, keeping your account number confidential is crucial to protect your financial information and prevent unauthorized transactions.

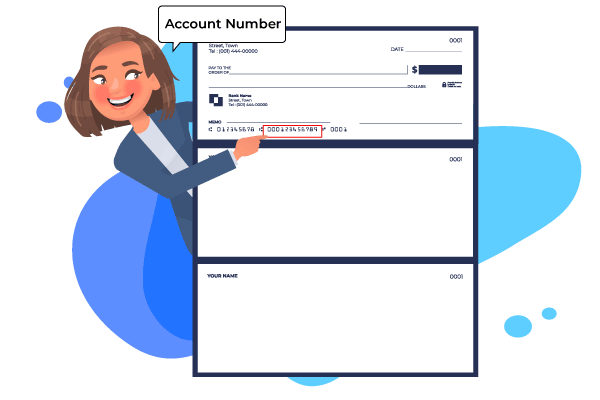

Locating the Account Number on a Check

The account number can be found at the bottom of your check. Typically, a check has three sets of numbers printed in a specific order. The account number is the second set, positioned between the nine-digit routing number and the check number. Account numbers usually have a minimum of nine digits and can contain up to 18 digits, depending on the bank.

The Importance of the Account Number on a Check

The account number on a check plays a vital role in ensuring the accuracy and security of your banking transactions. This unique number allows your bank to identify your account and process transactions accordingly. As your account number is sensitive information, it is crucial to keep it secret and refrain from sharing it with anyone you do not trust.

Streamlining Check Management with Zil Money

Zil Money is a cutting-edge check management solution that simplifies the process of printing and managing checks. With this platform, you can easily print checks with the correct account number on a check, routing number, and check number, ensuring error-free transactions. Moreover, it offers various security features to protect your account information and prevent unauthorized access.

Key Benefits of Using ZilMoney.com for Check Management

Customized Check Printing: ZilMoney.com enables you to design and print customized checks that reflect your brand identity. You can add your company’s image, choose from different check templates, and change the font styles and colors to fit your brand’s style.

Efficient Check Management: Its user-friendly interface makes it easy to manage multiple bank accounts and checks in one place. You can view the status of issued checks, track expenses, and generate insightful reports to make informed financial decisions.

Enhanced Security: It utilizes state-of-the-art encryption and security measures to protect sensitive financial information. The platform also offers additional security features such as watermarking, and micro printing, making it difficult for fraudsters to tamper with your checks.

Integration with Accounting Software: It integrates seamlessly with popular accounting software like QuickBooks, Zoho, Xero allowing you to sync your financial data and streamline your bookkeeping process.

Cost-Effective Solution: By printing your checks with ZilMoney.com, you can save money on pre-printed checks and reduce the risk of errors. The platform offers flexible pricing plans that cater to businesses of all sizes, making it a cost-effective check management solution.

Conclusion

Understanding the Importance of the account number on a check and knowing where to find it is crucial for efficient banking transactions. With ZilMoney.com, you can streamline your check management process while maintaining the security of your financial information. Not only does the platform offer customized check printing and efficient check management, but it also provides enhanced security features and seamless integration with accounting software.